If you wish to discover higher worth when shopping for a home, keep away from the actual property frenzy zone.

The actual property frenzy zone is the value vary the place the most important variety of patrons can compete. It typically spans from the median dwelling worth plus about 50%. That is the place demand is thickest, feelings run hottest, and patrons routinely overpay.

When you as a substitute transfer up the housing worth curve, simply past the frenzy zone, demand drops sharply. Fewer certified patrons means much less competitors, longer days on market, and higher negotiating leverage. In lots of circumstances, you find yourself paying much less per sq. foot for a greater property.

Why the Actual Property Frenzy Zone Exists

The frenzy zone exists due to each math and human conduct. Shopping for actual property is likely one of the most emotional selections folks make, largely as a result of house is the place we spend most of our time. Consequently, our hopes, id, and desires change into deeply intertwined with the place we dwell and sleep.

Properties priced close to the median are inexpensive to the most important variety of households, particularly dual-income households. Lenders are snug underwriting these patrons, the bank of mom and dad are extra keen to assist with down funds, and patrons psychologically anchor to “cheap” worth factors.

Properties priced beneath the median usually promote immediately as first-time patrons with no expertise compete aggressively. Properties priced modestly above the median additionally entice intense demand as a result of patrons stretch, believing it’s their “forever home.”

In fact, the problem is having sufficient capital to afford a house above the frenzy zone. Which will require stretching financially, promoting higher-risk property, or reallocating capital you hadn’t initially deliberate to make use of. Perhaps you will must work additional exhausting to get that promotion and pay elevate earlier than you submit affords. Alternatively, some patrons make their case to oldsters who’re keen to lend the funds to assist them clear the subsequent pricing tier.

Lending Requirements Make the Frenzy Worse

Tighter lending requirements amplify this impact.

Banks more and more require 720+ credit score scores, substantial reserves, and 20% down funds. Jumbo loans are more durable to acquire, particularly for self-employed patrons or these with variable revenue.

Consequently, competitors collapses as soon as costs exceed what most households can comfortably finance. That is the place disciplined patrons can strike.

The very last thing I would like you to do is get into an intense bidding war and have purchaser’s regret for beating out a dozen different bidders who weren’t keen to pay what you paid.

My First Lesson in Avoiding the Frenzy Zone

In 2004, I used to be seeking to improve from a two-bedroom apartment to a three-bedroom, two-bathroom apartment in San Francisco. I had bought my first apartment in 2003 for $580,000 and a 12 months later, regretted not shopping for one thing bigger as costs elevated.

What I discovered was brutal.

Each three-bedroom apartment priced between $900,000 and $1,400,000 was a feeding frenzy. Properties routinely bought for 10% to twenty% over asking after a number of supply battles. After shedding a number of instances, I gave up. Emotionally, it was exhausting.

A Fortunate Discovery Above the Frenzy Zone

Then one wet weekend, I stumbled throughout a single-family dwelling listed at $1,550,000, simply above the true property frenzy zone.

It sat on across the nook from a busy avenue, but it surely had three bedrooms, two bogs, an in-law unit, a yard, and a deck. Most significantly, it had been sitting available on the market for a month through the winter vacation.

There was nearly no competitors.

As a substitute of paying $1.4 million for a $1,300,000 apartment at $1,100 per sq. foot, I purchased the home for $1,525,000 at roughly $720 per sq. foot.

Shifting up the value curve delivered a 35% low cost per sq. foot.

Why No one Else Purchased It

The home was poorly marketed by an out-of-town agent utilizing a flimsy one-page flyer. It was not staged or cleaned, and the house owners wished a rent-back.

In 2004, mortgage charges have been close to 6%, family incomes have been decrease, and $1.5 million felt like an not possible psychological barrier. Even the Financial institution of Mother and Dad had limits.

That is how synthetic worth ceilings kind.

On the time, I by no means thought I’d be capable of purchase a single-family dwelling in San Francisco given my age and revenue. But this was the most cost effective home I might afford simply above the frenzy zone, in the most effective neighborhood I might discover. So I took a leap of religion and went all in, entering into contract earlier than my 2004 year-end bonus hit my checking account in early 2005.

After placing down 20%, or $315,000, I’d have had nearly nothing left. Feeling home wealthy and money poor was deeply uncomfortable. However I figured I used to be younger sufficient at 28 to take the danger. If I misplaced every little thing, which I almost did through the world monetary disaster, I’d merely grind my means again.

Fortunately, I survived the mass layoffs and finally sold the home in 2017 for a profit after no person wished to purchase it after I first listed it in 2012, the 12 months I retired from finance.

My Second Expertise Avoiding the Actual Property Frenzy Zone

In 2019, as we have been anticipating our second baby, we determined it was time to improve to a bigger dwelling. Coincidentally, a home two doorways down was being prepped on the market. It had one further stage and roughly 700 extra sq. ft, bringing the overall to about 2,540 sq. ft. All three ranges loved panoramic ocean views, however, like our first dwelling, it was another fixer.

Given the scale and placement, the itemizing agent deliberate to record the house at $1.98 million, hoping to whip up a frenzy and push the value to $2.1 million or greater. On the time, I knew that including an additional stage with comparable views would price not less than $750,000, if no more. From a replacement-cost perspective, the home struck me as wonderful worth. Additional. the home additionally had about 350 sqft of dwelling growth potential.

Fairly than leaping right into a bidding conflict, I targeted on constructing relationships. I related with the itemizing agent and the 2 grownup daughters who had inherited the house. I wrote every of them a thoughtful real estate love letter, explaining that our household was rising and that we hoped to renovate the home and make it our long-term dwelling. We weren’t flippers. We have been neighbors who wished to protect and enhance the property.

Ultimately, the technique labored. We bought the house beneath the deliberate record worth and prevented the competitors solely. It additionally helped that we paid money. True to my phrase, we modernized the home, moved in, and nonetheless personal it immediately.

The Metropolis Got here After Me

I do know we received an amazing deal as a result of a 12 months later, the town got here after me for extra money.

The assessor’s workplace questioned the acquisition worth, requested for photographs documenting the house’s authentic situation, and even wished to talk with the itemizing agent. Town finally reassessed the property at a price roughly 15% greater than what I paid to extract extra property tax from me.

That battle alone would possibly deserve its personal publish. It was a whole ordeal.

How the Actual Property Frenzy Zone Has Shifted

Right this moment, the standard San Francisco homebuyer family earns between $400,000 and $800,000 a 12 months. We’re typically speaking about dual-income households, lots of them in tech. On the similar time, the position of the Financial institution of Mother and Dad in serving to grownup youngsters purchase houses has grown bigger than ever.

The reason being easy: many of those mother and father have skilled extraordinary wealth creation over the previous 20-plus years via shares, actual property, and different asset courses. Consequently, they now have each the willingness and the power to assist their youngsters bridge the hole between revenue and immediately’s housing costs. For grownup youngsters with good relationship with their mother and father, housing affordability has also gone up.

Due to this dynamic, the frenzy zone has shifted upward – from topping out round $1.5 million in 2005 to roughly $3 million immediately. For 3- or four-bedroom, two- or three-bath single-family houses on the west side of San Francisco, patrons within the $2–$3 million vary are out in full drive.

These patrons are usually totally preapproved, are available in with $400,000 – $600,000 down funds, and nonetheless have one other $100,000 or extra in reserves. However the true X-factor is parental help.

As soon as costs push past $3 million, demand thins once more as the client pool shrinks dramatically. Properties at that stage usually require $800,000 or extra in liquid capital, which eliminates numerous in any other case high-earning households. Even amongst high earners with rich mother and father, many hesitate to pay attention that a lot capital right into a single asset far above the median worth.

That hesitation is the place alternative begins, if you happen to can afford it.

Instance of Battling It Out within the Frenzy Zone Right this moment

Faux you’re a actual property agent searching for a three-bedroom, single-family dwelling or bigger in your shoppers. The shoppers are a late-30s couple with a two-year-old who each work and earn about $600,000 a 12 months, all in, with about $500,000 for a down cost. Additionally they hope to have one other baby.

Beneath is a stunning three-bedroom, two-and-a-half-bath single-family dwelling that listed for $2.495 million within the Inside Sundown neighborhood of San Francisco. It was doubtless transformed inside the previous 15 years and contains an unwarranted recreation room on the bottom stage. Whereas the house has no views, it sits on an almost double lot, roughly 4,617 sq. ft, which is a significant differentiator within the neighborhood. The stroll rating is nice.

This might be a perfect dwelling for a household of three, with one bed room doubling as a visitor room or dwelling workplace. Regardless that the pandemic is lengthy over, many professionals nonetheless do business from home one or two days per week – the most effective lasting advantages of the pandemic for working mother and father. However ideally, this household desires 4 bedrooms.

At $2.495 million, the house was squarely in the true property frenzy zone. Given the larger-than-average lot dimension, you’d fairly count on it to command a premium relative to houses sitting on customary 2,500-square-foot tons. It additionally has two-car parking in addition.

Curiously, the itemizing agent didn’t disclose inside sq. footage. Public information present the house as a two-bedroom, two-bathroom property with 2,525 sq. ft. Nevertheless, the unwarranted recreation room on the decrease stage was properly staged and fully usable. In sensible phrases, the house doubtless provided nearer to three,000 sq. ft of livable house.

How A lot Would You Provide for This House?

If I have been representing the client, I’d have guided towards a most supply of $3 million, paired with a $900,000 down cost (+$300,000 assist from mother and father), a 30-day shut, and no financing contingency. The additional 500 sq. ft of usable house actually provides worth. However unwarranted house trades at a reduction to permitted dwelling space. Relying on the situation, we’re speaking a couple of 30% – 90% low cost.

Usually, I’d suggest an inspection contingency. However with not less than 5 different bidders within the combine, I doubtless would have suggested waiving it to have a shot. I’ve bought a number of houses with out inspection contingencies by spending hours on-site with licensed professionals earlier than committing. So that’s what we might do on this situation whereas additionally highlighting real looking house-improvement bills.

Absolutely, providing 20% above asking with a big down cost and no contingencies would hold us aggressive. On the very least, we’d count on a counter.

Unsuitable like Donkey Kong!

The Closing Promoting Value Astounds

The home finally bought for 60% above asking, closing at $4.05 million. Primarily based on the timeline – going into contract simply three days after itemizing and shutting two weeks later – I assume it was an all-cash transaction. Banks merely don’t fund purchases that rapidly given underwriting and documentation necessities.

In multiple-bid conditions, some patrons lose all sense of restraint. As their imaginative and prescient of dwelling within the dwelling begins to slide away, logic provides strategy to emotion. And when desires are on the road, cash turns into secondary, particularly you probably have loads of it.

The patrons have successfully reset pricing for comparable three-bedroom, two-and-a-half-bath houses within the neighborhood. There’s an actual chance they purchased at or near the top of the market and will expertise a loss if they should promote inside the subsequent three to 5 years.

Then again, if anticipated IPOs from corporations like OpenAI, Anthropic, Databricks, SpaceX, and different main tech companies materialize, a brand new surge of liquidity might push San Francisco actual costs to even greater ranges. That’s the wager they’re making.

When my fictitious shoppers are disenchanted after shedding by $1.05 million, I attempt to reframe the end result. Being that far off means we have been by no means actually within the recreation to start with. Strategically, I’d a lot relatively information patrons towards houses within the $3–$3.5 million vary, the place competitors drops off sharply and rational pricing re-enters the image.

That’s the place alternative tends to dwell.

Your House Shopping for Mission

If you’re shopping for close to all-time highs, you have to be strategic.

Keep away from the true property frenzy zone (median worth + about 50%) the place any dual-income family can compete. That’s the place worth is lowest and threat is highest.

As a substitute:

- Transfer one worth tier greater than you might be snug with

- Search for stale listings that scare different patrons

- Use the spray n’ pray methodology to make a number of affords given every supply takes lower than 5 minutes so that you can signal

- Concentrate on worth factors that patrons resist psychologically

- Predict the Future Frenzy Zone for the neighborhood you need to purchase

Widespread resistance ranges embrace $500,000, $1 million, $1.5 million, $2 million, $2.5 million, $3 million, $3.5 million, $5 million and past.

If you’re keen to maneuver up the housing worth curve, you can be shocked by how a lot better worth yow will discover when you escape the true property frenzy zone. Better of luck on the market!

Readers, are you keen to look one tier above the true property frenzy zone to search out higher worth – simply as you’re keen to eat lunch at 1:30 p.m. to keep away from the crowds or depart after 7 p.m. to overlook rush-hour visitors? Or will you attempt to purchase within the worth vary everybody else can afford and easily hope your bid comes out on high? What’s the true property worth frenzy zone in your space?

Make investments In Actual Property With out The Aggressive Frenzy

After a number of years of underperformance, actual property is lastly trying engaging, not less than from a capital preservation perspective. Valuations have compressed, transaction quantity stays muted, and plenty of sellers are nonetheless anchored to yesterday’s costs. Traditionally, that is the section when affected person capital tends to do greatest.

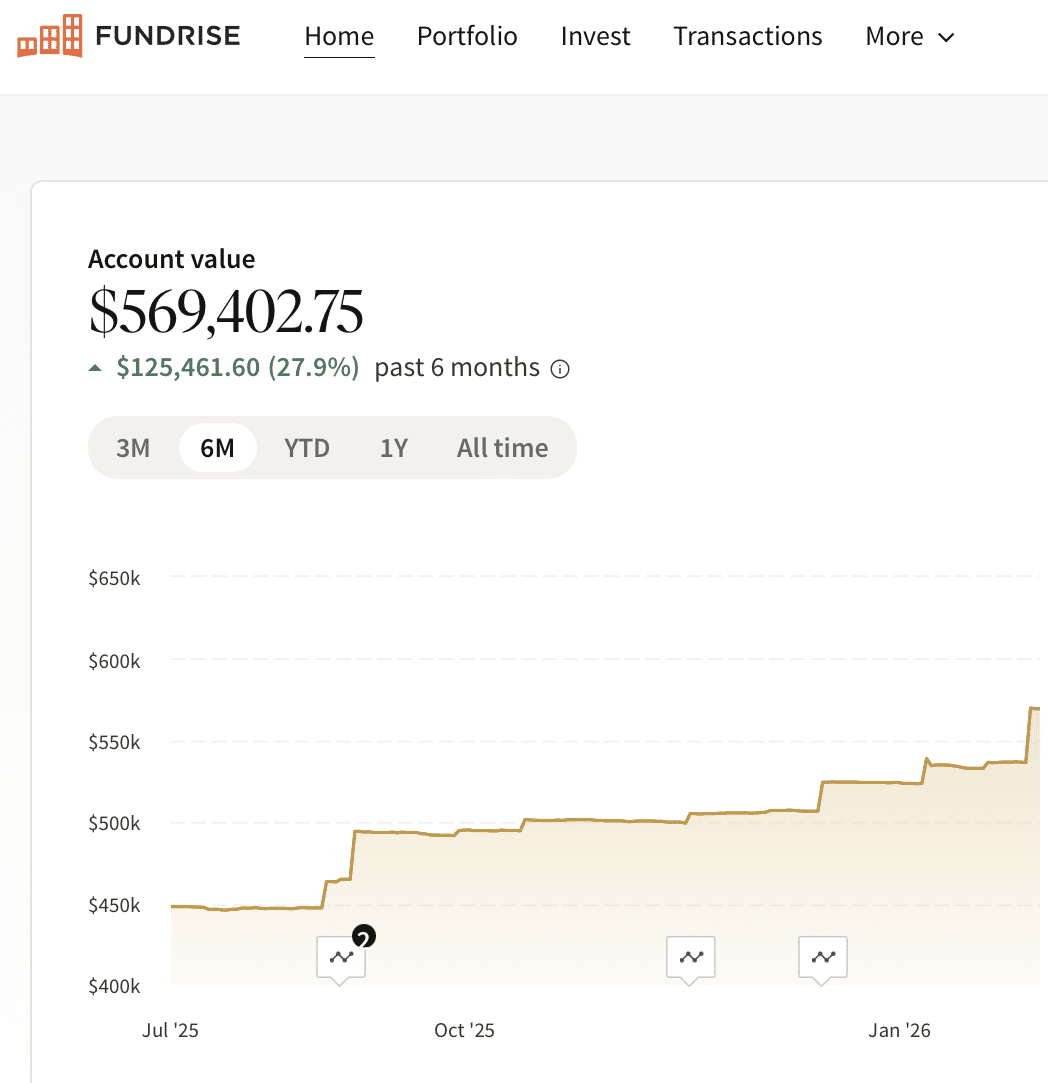

One choice price exploring is Fundrise, which lets you make investments passively in residential and industrial actual property throughout the nation. With round $3 billion in property below administration, Fundrise focuses closely on Sunbelt markets – areas with decrease entry costs, bettering fundamentals, and the potential to profit as actual property cycles flip over the subsequent a number of years.

For buyers in search of extra asymmetrical upside, Fundrise Venture affords publicity to non-public expertise and AI corporations akin to OpenAI, Anthropic, and Databricks. Enterprise is inherently greater threat, but in addition the place probably the most explosive progress tends to happen, particularly as synthetic intelligence reshapes productiveness and the labor markets.