Unlock the White Home Watch publication at no cost

Your information to what Trump’s second time period means for Washington, enterprise and the world

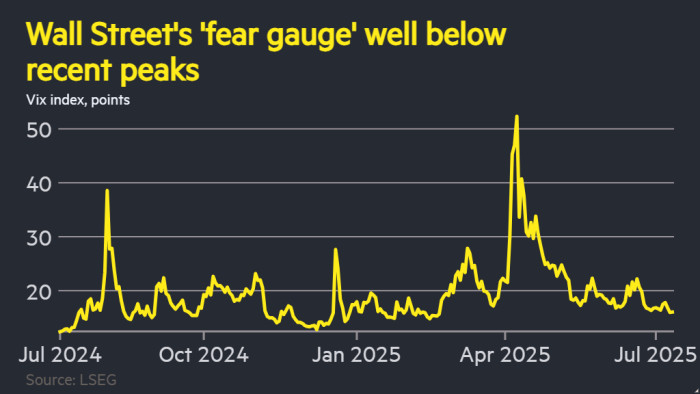

Market volatility has dropped to close its lowest ranges of the 12 months and shares are buying and selling at report highs as anxiousness over Donald Trump’s tariffs melts away regardless of the most recent escalation of his commerce struggle.

The Vix index, a measure of short-term anticipated volatility within the S&P 500, has fallen to 16, nicely beneath its long-run common of about 20. An identical index for anticipated volatility within the US authorities bond market is near its lowest ranges in three years.

On the identical time, Nvidia has led a surge in tech shares because the chipmaker reached an unprecedented $4tn valuation on Wednesday.

The strikes come even because the US president unleashed a barrage of recent commerce threats this week, together with a 50 per cent tariff on copper, 200 per cent on the pharmaceutical sector and levies on international locations together with Japan, South Korea and the Philippines.

“I don’t care about tariffs any extra,” stated Max Kettner, head of multi-asset technique at HSBC. “That is all self-imposed. What’s to cease them saying, let’s give it one other three months?”

Trump’s newest strikes on tariffs deliver their ranges nearer than some analysts had anticipated to the steep duties he unveiled in early April on dozens of US buying and selling companions.

Nevertheless, these preliminary so-called “reciprocal” tariffs have been later postponed and renegotiated after shares cratered, and Trump then pushed again once more the deadline for implementing the duties from July 9 to August.

Because of this, traders at the moment are taking the US president’s present threats a lot much less significantly than they took his early rhetoric, and are betting that the president will in the end step again from tariffs that significantly hurt US progress.

The commerce has develop into identified in markets as “Taco”, an acronym for “Trump All the time Chickens Out”.

“Might 12 onwards, that was the massive game-changer,” stated Kettner, referring to the date the US struck a take care of China wherein each side sharply decreased their beforehand deliberate tariffs, prompting traders to maneuver again into dangerous belongings.

“We discovered that there’s a Trump put,” he added.

In forex markets, Trump’s menace of fifty per cent tariffs on Brazil knocked the true on Wednesday, however broader markets are calm.

CME Group indices of anticipated swings in trade charges akin to euro-dollar are considerably down from their April highs and are at roughly the extent the place they traded initially of the 12 months.

“There’s a view that the Trump administration is unlikely to need a repeat of the disruption triggered by the ‘liberation day’ tariffs in early April,” stated Lee Hardman, senior forex analyst at MUFG.

Matthias Scheiber, head of multi-asset at US asset supervisor Allspring International Investments, stated: “I can see it being examined, however would count on the Taco commerce to remain, with any volatility presenting a shopping for alternative.”

However traders warned that the exuberant sentiment in fairness markets in itself might encourage Trump to extend his aggression on commerce greater than the market at current anticipates.

“With US equities at a report excessive and the funds handed, there’s a threat Trump may very well be emboldened to go tougher with tariffs than anticipated,” stated Hardman.

Some traders are extra alarmed that the market is pricing in a level of complacency, with the S&P near report highs and buying and selling at a ahead price-to-earnings ratio of 24. Inventory indices within the UK and Germany are buying and selling at all-time peaks.

“My concern is that there’s not an excellent margin of security now in valuations,” stated Kasper Elmgreen, chief funding officer of equities and stuck revenue at Nordea Asset Administration.

“We now have the most important improve in tariffs in anyone’s residing reminiscence, however [the market] is taking a really relaxed view on what that may do,” stated Elmgreen. “I’m involved concerning the lack of concern.”