Canada’s excessive

is eroding the arrogance of its residents in the case of their

Two-thirds of Canadians say inflation has made it tough to avoid wasting for retirement, whereas 74 per cent mentioned excessive costs have added to the issues that their retirement nest egg is probably not sufficient, in keeping with a

by Financial institution of Montreal.

Canada’s

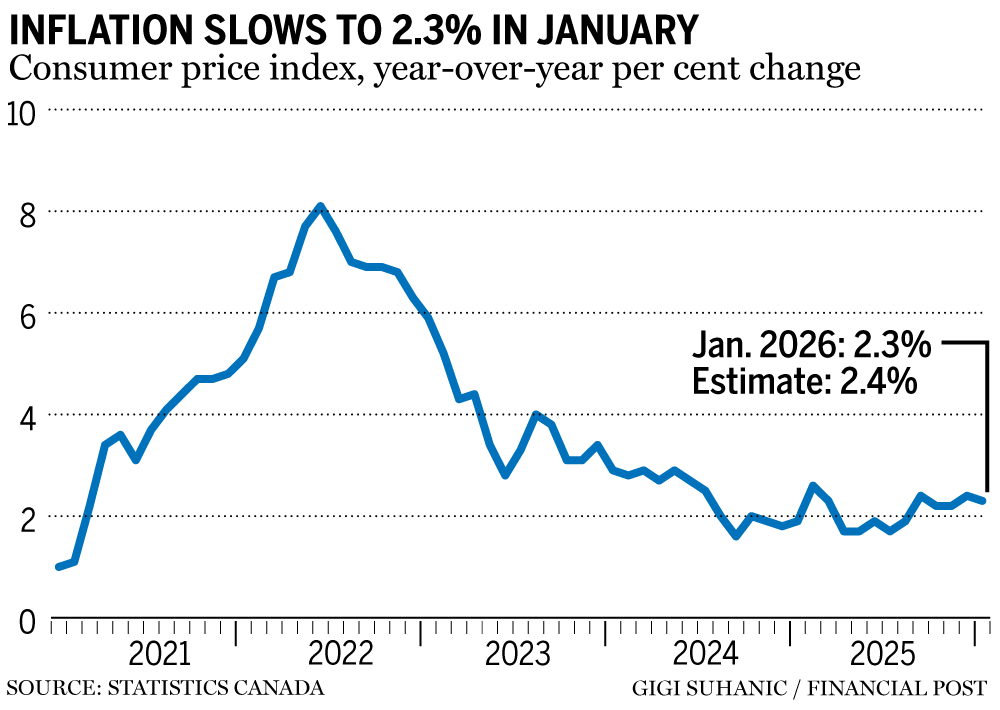

inflation rate inched lower to 2.3 per cent

in January, however a 16.7 per cent drop in gasoline costs was the principle issue behind the dip. With out gasoline costs, inflation was three per cent, proper on the higher restrict of the Financial institution of Canada’s goal vary.

Amongst those that mentioned inflation is hurting their financial savings prospects, about half mentioned they’re paying between $100 and $300 extra per thirty days for requirements, whereas a 3rd mentioned it’s costing them greater than $300 further.

Canadians are attempting to make up the distinction, with 31 per cent saying they’re contributing much less to retirement, 27 per cent are slicing again on spending and 17 per cent are pausing retirement financial savings altogether.

In consequence, they could be falling behind on retirement financial savings. Canadians are earmarking about 3.74 per cent of their disposable revenue for retirement, amounting to about $3,570 per 12 months, in keeping with a

report by Fidelity Investments Canada ULC

.

Constancy mentioned Canadians below the age of 35 have median family financial savings of $159,100, which grows to $738,900 for these 65 years of age or older.

However BMO mentioned Canadians are anxious about their cash lasting. Whereas 30 per cent mentioned they don’t know the way lengthy their financial savings may final, 22 per cent mentioned they’d final between 10 and 20 years and simply 13 per cent consider they are going to final greater than 30 years.

BMO recommends retirement savers begin planning early, keep financial savings plans as a part of their common bills and search skilled recommendation to suggest new saving methods.

“The bottom line is to remain invested and take a proactive strategy,” Brent Joyce, chief funding strategist at BMO Personal Wealth, mentioned in a launch. “By incorporating inflation assumptions into complete monetary plans, we assist Canadians perceive how their portfolios can carry out over a long time — not simply years. With disciplined investing and skilled steering, shoppers can guarantee their cash grows sooner than inflation and helps the approach to life they’ve envisioned.”

Sign up here to get Posthaste delivered straight to your inbox.

Canada’s inflation fee slowed to 2.3 per cent year-over-year in January, as a steep drop in gasoline costs moved the general fee down.

In whole, gasoline costs dropped 16.7 per cent within the month, which means inflation with out gasoline truly ticked as much as three per cent.

The GST/HST vacation in early 2025 meant that restaurant costs climbed 12.3 per cent final month, whereas different merchandise lined below this system, together with toys, clothes and alcohol, additionally rose.

The figures have some economists suggesting that the door could also be opening for the

to chop rates of interest as soon as once more.

- 2:00 p.m.: U.S. Federal Open Market Committee minutes

- As we speak’s Information: Canada current residence gross sales and MLS residence value index for December, U.S. housing begins for November and December

- Earnings: HSBC Holdings Plc, Rin Tonto Plc, DoorDash Inc., Kinross Gold Corp., Nutrien Ltd., Molson Coors Beverage Co.

- Cooler inflation gives Bank of Canada an opening to cut rates if economy falters, say economists

- Taxing unrealized gains is a silly idea that Canada should ignore

- Canada’s inflation rate cools to 2.3% as gas prices fall

- Ontario designates Kinross Gold’s Great Bear project for speedy permit approval

- Emmanuelle Gattuso has a radical idea: take names off buildings when the price is right

For these terrified of working out of cash in retirement, a fast evaluation from a monetary planner can go an extended solution to encourage confidence or ensure you are heading in the right direction. These conferences can even assist with understanding all of your investments and the place to go from there.

All in favour of vitality? The subscriber-only FP West: Power Insider publication brings you unique reporting and in-depth evaluation on one of many nation’s most necessary sectors.

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s

may help navigate the complicated sector, from the most recent developments to financing alternatives you gained’t need to miss. Plus test his

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

As we speak’s Posthaste was written by Ben Cousins with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters here