Bitcoin ETF inflows are accelerating the affect of institutional traders available on the market, reshaping BTC’s provide dynamics and total construction. As these ETFs have flooded into the area, many see this wave of institutional participation as an unprecedented shift in Bitcoin’s narrative. However what if this institutional information may very well be used not simply to watch the market, however to outperform bitcoin itself?

Who Actually Buys Bitcoin ETFs? Defining ‘Institutional’

The time period “institutional” is regularly used as shorthand for ETF patrons, however in actuality, these inflows signify a mixture of high-net-worth people, household places of work, and a few precise institutional funds. Maybe solely 30–40% are what we might think about true establishments. Regardless, ETF Cumulative Flows have grown exponentially to virtually 1.2 million BTC since January 2024. That’s a transformative quantity, arguably eradicating a significant chunk of accessible provide from the open market indefinitely.

This sort of accumulation, particularly when paired with long-term holding conduct from treasury corporations and doubtlessly even nation-states, has completely altered Bitcoin’s liquidity profile. These cash could by no means re-enter circulation.

Turning ETF Move Information Right into a Worthwhile Bitcoin Buying and selling Technique

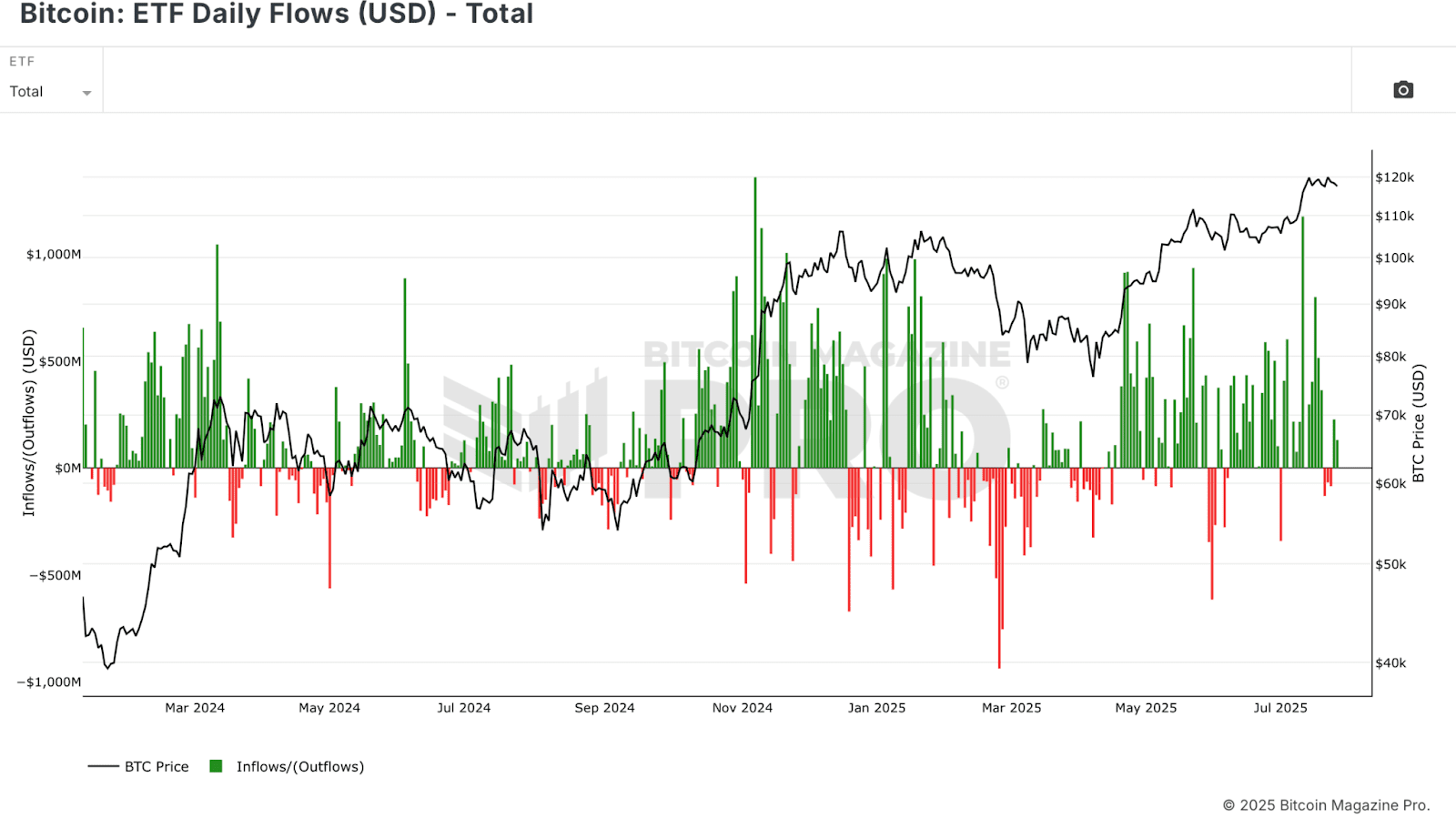

Many assume these ETF members are the epitome of good cash, savvy traders transferring in opposition to the grain to take advantage of retail sentiment. However the information tells a unique story. Evaluation of the ETF Daily Flows (USD) chart reveals a herd-like conduct of shopping for closely into native tops and capitulating at native bottoms.

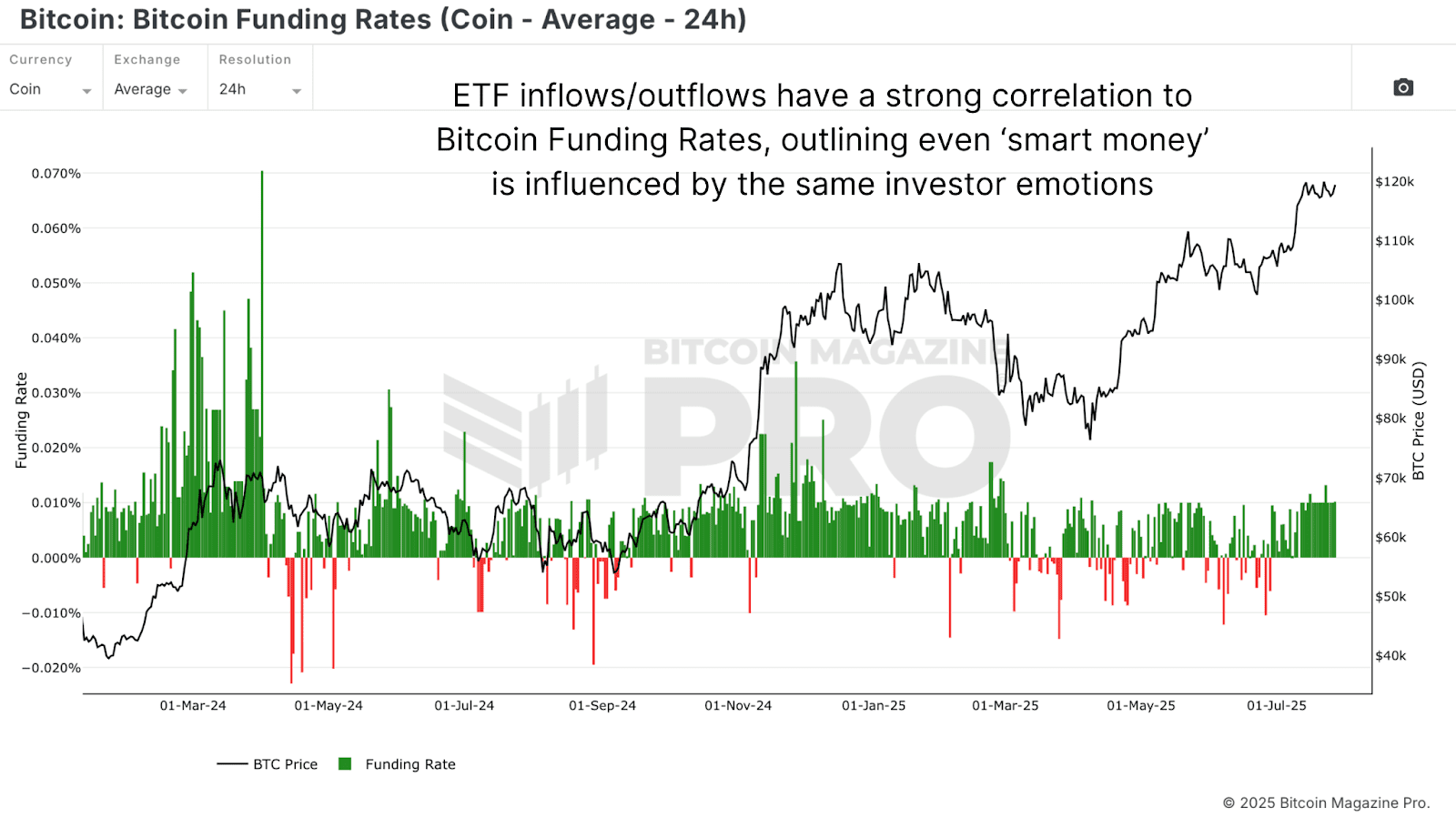

A comparability between ETF Flows and Bitcoin Funding Rates, a retail sentiment barometer, reveals an uncanny synchronicity. Establishments are basically shopping for and promoting in lockstep with retail, not forward of them. This shouldn’t be shocking. Human psychology, cognitive bias, and FOMO don’t cease affecting folks simply because they handle massive sums of cash. Even treasury departments of enormous companies usually find yourself shopping for into bullish euphoria.

Bitcoin ETF Move Technique vs. Purchase-and-Maintain: The Outcomes

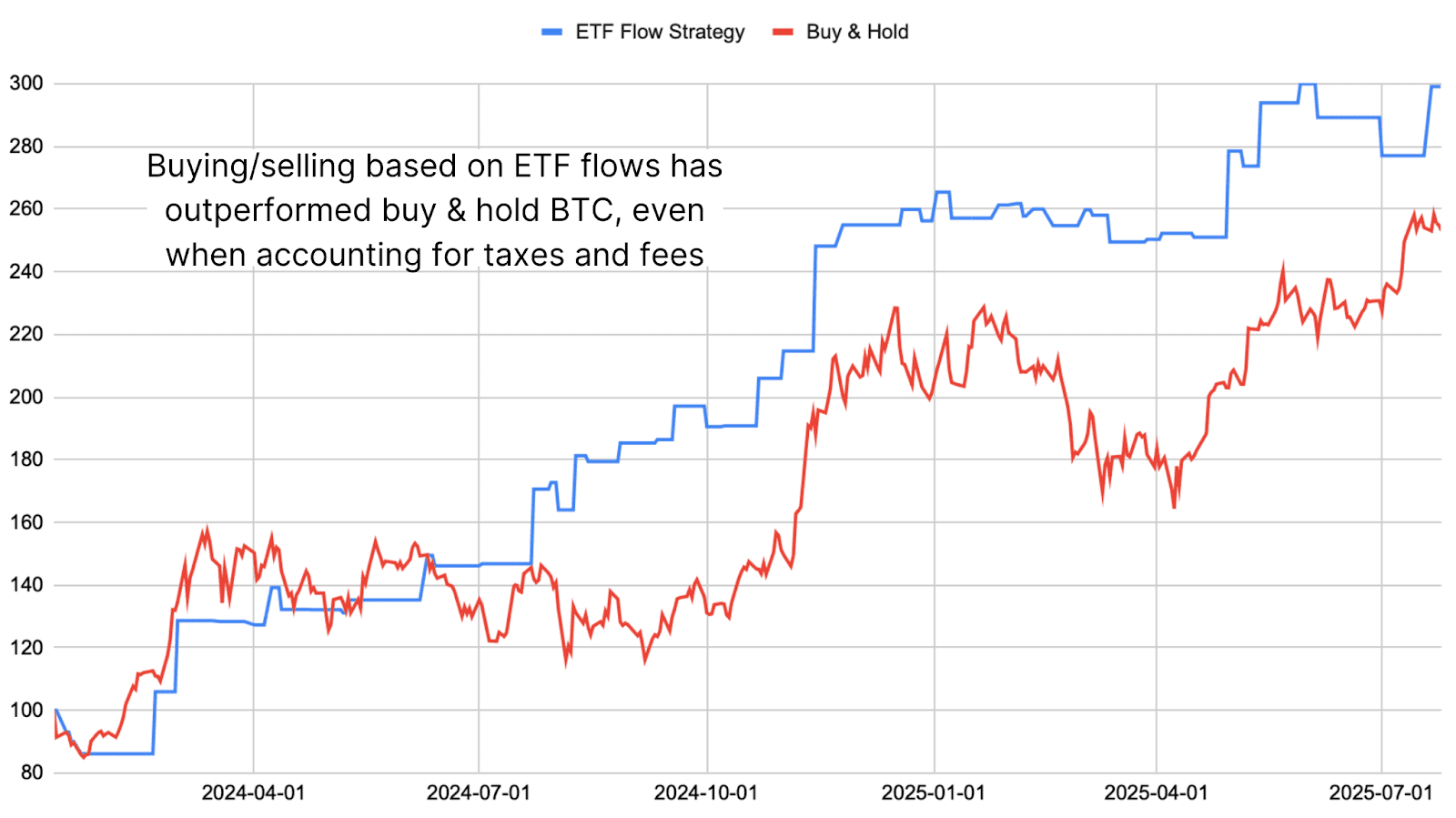

If ETF patrons are merely following the pattern of shopping for as value will increase and promoting as value decreases, then their inflows and outflows can function a possible entry/exit sign, or higher but, as a momentum indicator when interpreted appropriately. To check this principle, we created a easy technique utilizing ETF move information through the Bitcoin Magazine Pro API.

The logic is simple: purchase Bitcoin when ETFs present inflows, and promote once they present outflows. It isn’t an ideal sign; early trades present drawdowns and a noticeable underperformance in contrast to purchase and maintain, however when this technique is utilized over the total span since ETFs launched, the returns are spectacular. Almost 200% versus roughly 155% for a buy-and-hold technique. Even when factoring in a nominal 20% taxation price on worthwhile trades, the technique nonetheless outperformed.

Ought to You Use a Bitcoin ETF Move Technique?

This sort of tactical technique isn’t for everybody. Many Bitcoiners are long-term holders who would by no means think about promoting. However for these prepared to handle threat and seize edge out there, this ETF-based technique presents a approach to leverage the conduct of the large market members.

So, does following institutional flows provide you with an edge? By itself, most likely not a constant one. Whereas undoubtedly spectacular, it has labored this lengthy, I personally have doubts this may work over a number of cycles. However paired with the broader market context, it turns into a great tool for gauging the pattern and reinforcing different indicators to compound returns.

Cherished this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for extra skilled market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to skilled evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding selections.