Ethereum is present process a important check after breaking above the important thing $2,850 resistance degree and reaching an area excessive of $3,080. Since then, ETH has retraced by lower than 5%, holding regular and exhibiting indicators of power amid broader market volatility. The flexibility to take care of ranges above $2,850 is being intently watched by merchants and analysts as a possible launchpad for the following leg increased.

Associated Studying

Market sentiment stays more and more optimistic, fueled by robust fundamentals and indicators of institutional accumulation. Based on on-chain knowledge, SharpLink Gaming—one of many first Nasdaq-listed corporations to develop a treasury technique centered on Ethereum—bought one other $73,210,000 value of ETH yesterday. This marks one other robust sign that good cash is assured in Ethereum’s long-term worth.

Because the crypto market awaits key developments from US regulators throughout “Crypto Week,” Ethereum’s worth motion and on-chain indicators stay aligned with a bullish outlook. If ETH can maintain present ranges and construct momentum, the trail towards $3,500 turns into more and more sensible. With rising institutional demand and robust community fundamentals—together with document ETH staking—Ethereum seems well-positioned to guide the following part of the altcoin market rally.

SharpLink Turns into Largest Public ETH Holder With $611M in Ethereum

SharpLink Gaming has formally turn into the biggest publicly recognized holder of Ethereum, with complete holdings now reaching 205,634 ETH, valued at roughly $611 million. This milestone positions the Nasdaq-listed firm on the forefront of institutional Ethereum adoption, setting a brand new benchmark for company treasury methods within the crypto area.

High analyst Ted Pillows confirmed the newest buy by way of on-chain data, revealing that the transaction originated from a Coinbase Prime sizzling pockets, generally utilized by establishments for large-scale acquisitions. This transfer indicators growing confidence in Ethereum’s long-term worth, significantly as corporations start diversifying past Bitcoin to realize publicity to good contract infrastructure.

Ethereum’s technical setup stays robust, with worth holding effectively above the $2,850 assist zone following its current transfer to $3,080. On the identical time, fundamentals proceed to enhance. The ETH provide staked has reached new all-time highs, indicating that extra long-term holders are locking up their belongings slightly than promoting into power. Mixed with elevated institutional curiosity, this displays rising conviction in Ethereum’s function as a foundational layer for Web3.

The approaching weeks promise to be pivotal. With market sentiment turning bullish and Ethereum gaining traction in company circles, the stage is about for a sustained upward transfer, particularly if broader macro and regulatory situations stay favorable.

Associated Studying

ETH Holds Above Key Breakout Zone

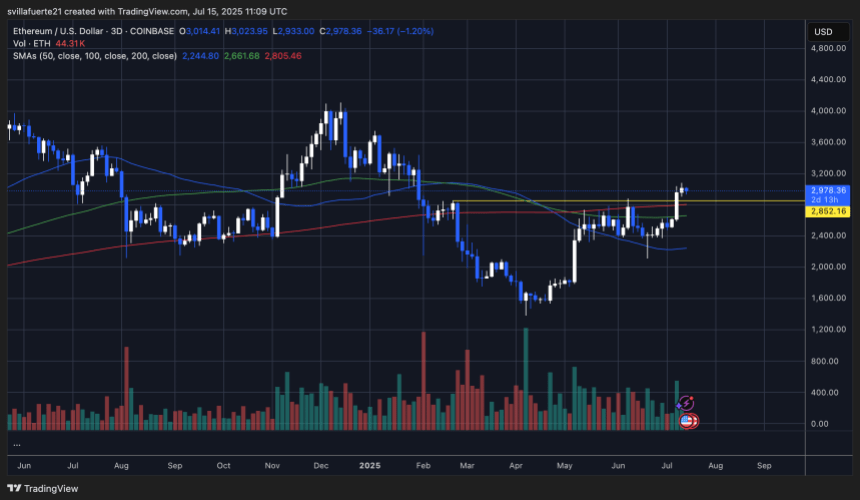

Ethereum’s 3-day chart reveals a bullish continuation sample, with worth at present holding at $2,978 after lately breaking by way of a important resistance zone at $2,850. The breakout marked a shift in momentum following a protracted consolidation part and pushed ETH to an area excessive of $3,041.41. Though a slight retracement adopted, the present construction stays robust as bulls efficiently defend the $2,850–$2,900 space.

This degree is especially necessary because it aligns with a number of technical indicators. The 200-day easy shifting common (SMA) sits at $2,805.46, now performing as dynamic assist. ETH additionally stays effectively above the 50-day and 100-day SMAs, at present at $2,244.80 and $2,661.68, confirming that the broader pattern has turned bullish.

Associated Studying

Quantity stays elevated, suggesting continued shopping for curiosity on dips. If ETH holds above $2,850 within the coming periods, the following logical goal is the $3,300–$3,500 zone, the place earlier highs and psychological resistance converge.

Featured picture from Dall-E, chart from TradingView