Ripple Labs’ long-running authorized struggle with the US Securities and Change Fee (SEC) is formally over after either side agreed to drop their appeals within the case.

Associated Studying

In keeping with experiences, a joint filing on August 7 confirmed the choice to the 2nd Circuit Courtroom of Appeals, ending an almost five-year dispute that has formed debate over how cryptocurrencies are regulated.

Again To Enterprise

Ripple’s chief authorized officer Stuart Alderoty stated on social media the matter was “over” and the corporate may get “again to enterprise.”

Following the Fee’s vote at present, the SEC and Ripple formally filed straight with the Second Circuit to dismiss their appeals.

The tip…and now again to enterprise. https://t.co/nVqthNcFOt

— Stuart Alderoty (@s_alderoty) August 7, 2025

Appeals Withdrawn, Penalties Finalized

Primarily based on reports, the SEC has withdrawn its problem to a 2023 ruling that XRP gross sales on public exchanges weren’t securities.

Ripple, in flip, dropped its personal enchantment on the discovering that institutional gross sales of XRP violated securities legal guidelines. Each events will shoulder their very own authorized bills.

The case’s decision finalizes $125 million in penalties first outlined by Decide Analisa Torres. Of that, $50 million will go to the US Treasury, whereas $75 million—held in escrow since June—shall be returned to Ripple.

The ruling additionally leaves in place a everlasting injunction stopping Ripple from making institutional XRP gross sales with out following securities legal guidelines.

It may be recalled that the litigation began in December 2020 when the regulatory physique charged Ripple with elevating $1.3 billion from unregistered securities choices.

Ripple protested innocence, claiming XRP isn’t a safety. In July 2023, Decide Torres agreed with the SEC on “programmatic” gross sales to institutional consumers however determined such sort of gross sales to retail purchasers weren’t deemed as “securities.”

Political Shift Shapes Final result

The transfer to droop appeals follows US President Donald Trump’s return to the White Home and appointment of recent bosses on the SEC.

In keeping with experiences, beneath the brand new chair, Paul Atkins, the company has backed away from greater than a dozen enforcement actions and investigations involving crypto corporations in current months.

Ripple CEO Brad Garlinghouse earlier stated each events had already agreed in June to place closure to their appeals, although negotiations to cut back the penalties failed.

In the meantime, market observers say the result is a mirrored image of the SEC’s softened strategy in different high-profile circumstances, together with these involving Coinbase and Kraken.

For the crypto business, this decision is being seen as an indication of adjusting tides in Washington’s stance in the case of regulation.

Associated Studying

XRP Sees Renewed Buying and selling Exercise

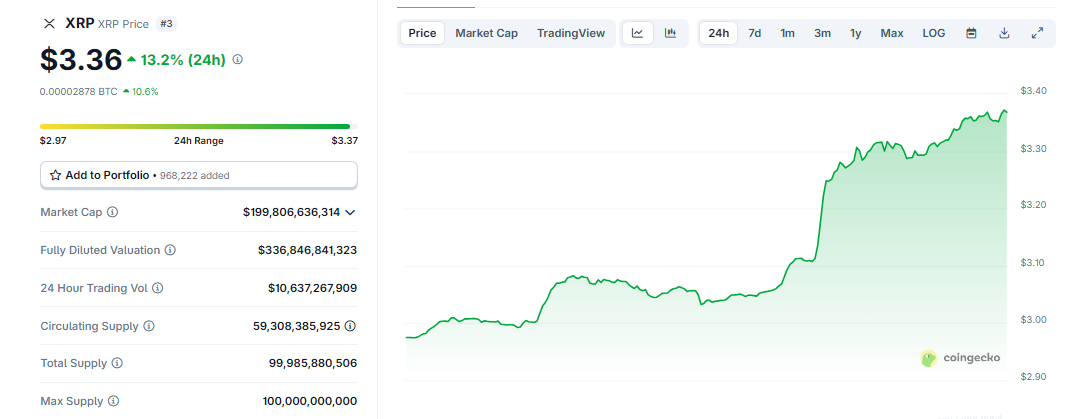

Following information of the case’s finish, XRP shot up 13%, registering a 24-hour buying and selling quantity of $9.50 billion—a rise of greater than 100% in contrast from the day gone by. XRP’s value has been climbing by round 14% within the final seven days, newest information exhibits.

Analysts say the sharp spike in exercise alerts renewed investor confidence now that the authorized cloud over Ripple has been cleared.

Featured picture from Meta, chart from TradingView