Company treasuries have surpassed exchange-traded funds (ETFs) in Bitcoin accumulation for the third consecutive quarter, in keeping with new knowledge from Bitcoin Treasuries. Public firms acquired roughly 131,000 BTC in Q2 2025—an 18% enhance from the earlier quarter—in comparison with an 8% uptick, or 111,000 BTC, amongst ETFs.

“The institutional purchaser who’s getting publicity to Bitcoin by the ETFs usually are not shopping for for a similar purpose as these public firms who’re mainly making an attempt to build up Bitcoin to extend shareholder worth on the finish of the day,” said Nick Marie, head of analysis at Ecoinometrics.

In April alone, public firm holdings rose 4% whereas ETFs elevated simply 2%. “They don’t actually care if the worth is excessive or low, they care about rising their Bitcoin treasury so they appear extra enticing to the proxy consumers,” Marie mentioned. “It’s not a lot pushed by the macro development or the sentiment, it’s for various causes. So it turns into a distinct sort of mechanism that may push Bitcoin ahead.”

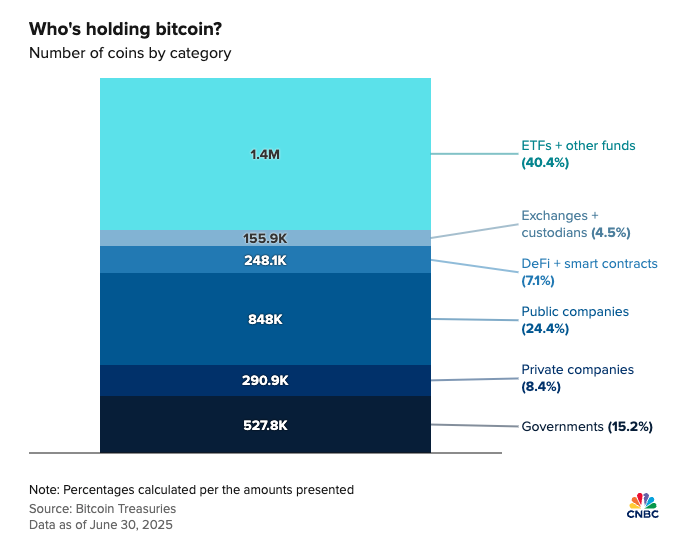

Regardless of the surge in company adoption, ETFs stay the most important entity holders of Bitcoin, controlling greater than 1.4 million BTC—about 6.8% of the mounted provide cap. Public firms now maintain round 855,000 BTC, or 4%.

Some analysts have linked the surge in company participation to the favorable policy shift below the Trump administration. In March, Trump signed an government order for a U.S. Bitcoin reserve, signaling sturdy federal assist for Bitcoin. The final quarter the place ETFs led in BTC accumulation was Q3 2024, previous to Trump’s reelection.

Current strikes embody GameStop’s entry into Bitcoin holdings, KindlyMD’s merger with David Bailey’s Bitcoin treasury firm, Nakamoto, and ProCap’s launch of a Bitcoin treasury technique forward of its public debut by way of SPAC.

Nonetheless main the pack is Strategy (previously MicroStrategy), which holds 597,000 BTC. “It’s going to be very laborious to catch Technique’s scale,” mentioned Ben Werkman, CIO at Swan Bitcoin. “They’re going to be the popular touchdown spot for institutional capital.”

Trying forward, Marie believes the present tempo of company Bitcoin adoption could not final eternally, suggesting this could possibly be a brief alternative. “You’ll be able to take into consideration this wave as a bunch of firms which might be making an attempt to learn from this arbitrage,” he mentioned.

Nonetheless, Werkman sees long-term worth within the mannequin. “What individuals actually like about these firms is that they’ll do one thing spot Bitcoin holders can’t: exit and accumulate extra Bitcoin in your behalf,” he defined.

Disclosure: Nakamoto is in partnership with Bitcoin Journal’s mum or dad firm BTC Inc to construct the primary world community of Bitcoin treasury firms, the place BTC Inc supplies sure advertising providers to Nakamoto. Extra info on this may be discovered here.