One of many dominant narratives this cycle has been that “this time is totally different.” With institutional adoption reshaping Bitcoin’s provide and demand dynamics, many argue that we gained’t see the form of euphoric blowoff high that outlined previous cycles. As an alternative, the thought is that sensible cash and ETFs will easy out volatility, changing mania with maturity. However is that basically the case?

Sentiment Drives Markets, Even for Establishments

Skeptics usually dismiss instruments just like the Fear and Greed Index as too simplistic, arguing that they’ll’t seize the nuance of institutional flows. However writing off sentiment ignores a elementary reality that establishments are nonetheless run by individuals, and other people stay liable to the identical cognitive and emotional biases that drive market cycles, no matter how deep their pockets are!

Though volatility has dampened in comparison with earlier cycles, the transfer from $15,000 to over $120,000 is much from underwhelming. And crucially, Bitcoin has achieved this with out the form of deep, prolonged drawdowns that marked previous bull markets. The ETF growth and company treasury accumulation have shifted provide dynamics, however the fundamental suggestions loop of greed, concern, and hypothesis stays intact.

Market Bubbles Are a Timeless Actuality

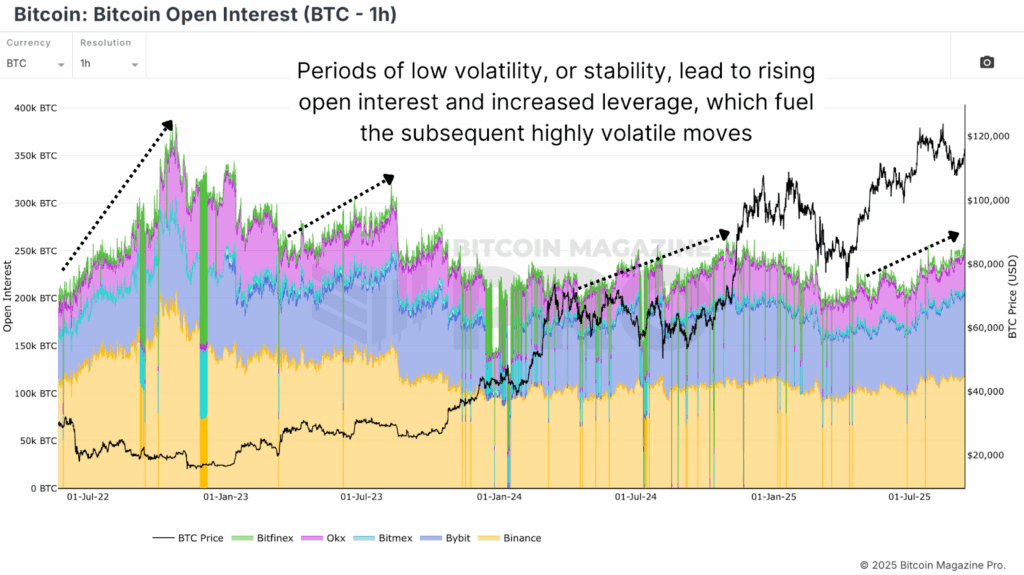

It’s not simply Bitcoin that’s vulnerable to parabolic runs, bubbles have been a part of markets for hundreds of years. Asset costs have repeatedly surged past fundamentals, fueled by human conduct. Research persistently present that stability itself usually breeds instability, and that quiet intervals encourage leverage, hypothesis, and ultimately runaway worth motion. Bitcoin has adopted this similar rhythm. Intervals of low volatility see Open Interest climb, leverage construct, and speculative bets improve.

Opposite to the assumption that “refined” traders are immune, analysis from the London Faculty of Economics suggests the other. Skilled capital can speed up bubbles by piling in late, chasing momentum, and amplifying strikes. The 2008 housing disaster and the dot-com bust weren’t retail-driven, however led by establishments.

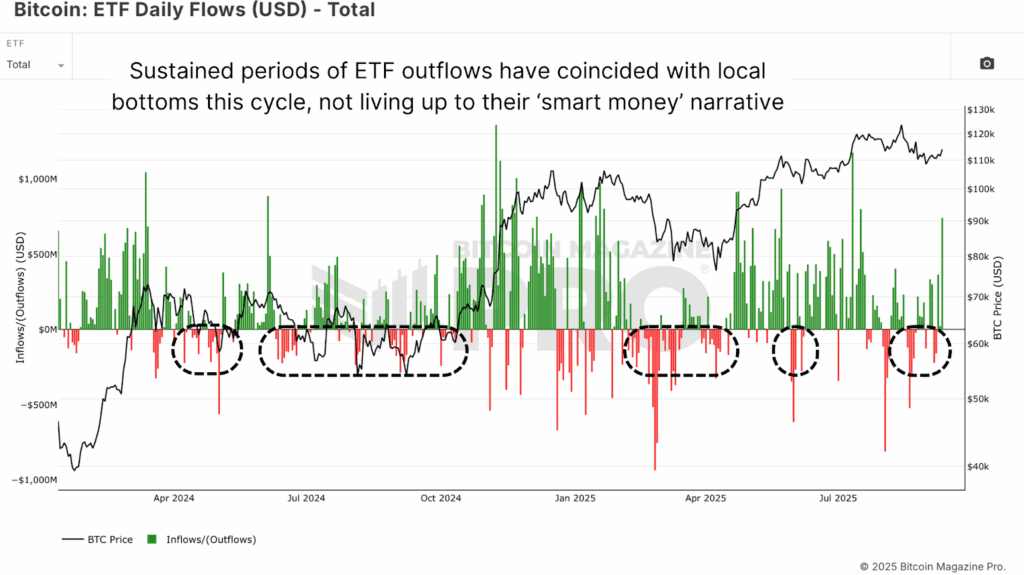

ETF flows this cycle present one other highly effective instance. Intervals of internet outflows from spot ETFs have really coincided with native market bottoms. Somewhat than completely timing the cycle, these flows reveal that “sensible cash” is simply as liable to herd conduct and development following investing as retail merchants.

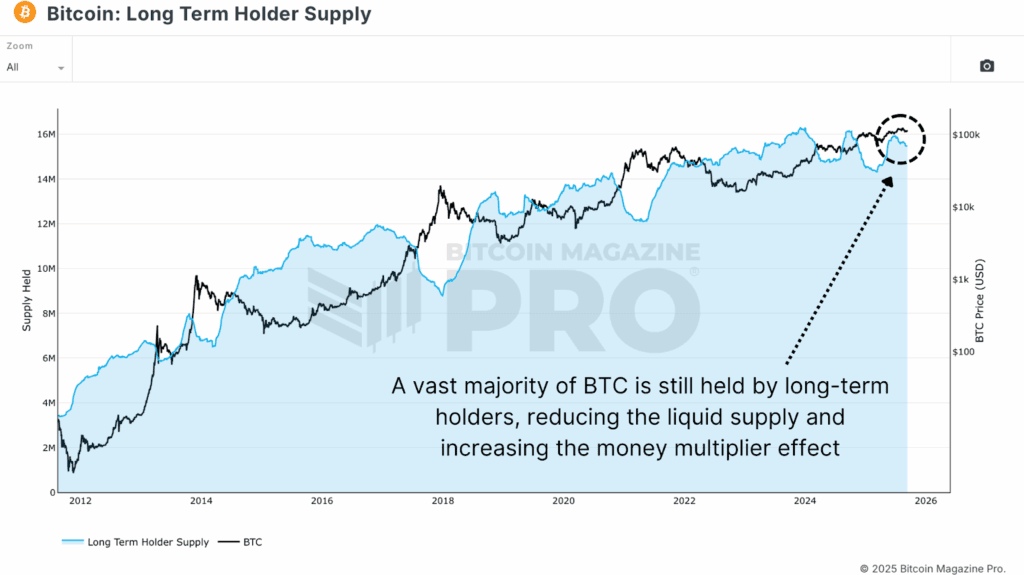

Capital Flows Might Ignite Bitcoin’s Subsequent Leap

In the meantime, international markets reveals how capital rotation may ignite one other parabolic leg. Since January 2024, Gold’s market cap has surged by over $10 trillion, from $14T to $24T. For Bitcoin, with a present market cap round $2T, even a fraction of that form of influx may have an outsized impact because of the cash multiplier. With roughly 77% of BTC held by long-term holders, solely about 20–25% of provide is quickly liquid, leading to a conservative cash multiplier of 4x. Meaning new inflows of $500 billion, simply 5% of gold’s latest enlargement, may translate right into a $2 trillion improve in Bitcoin’s market cap, implying costs effectively over $220,000.

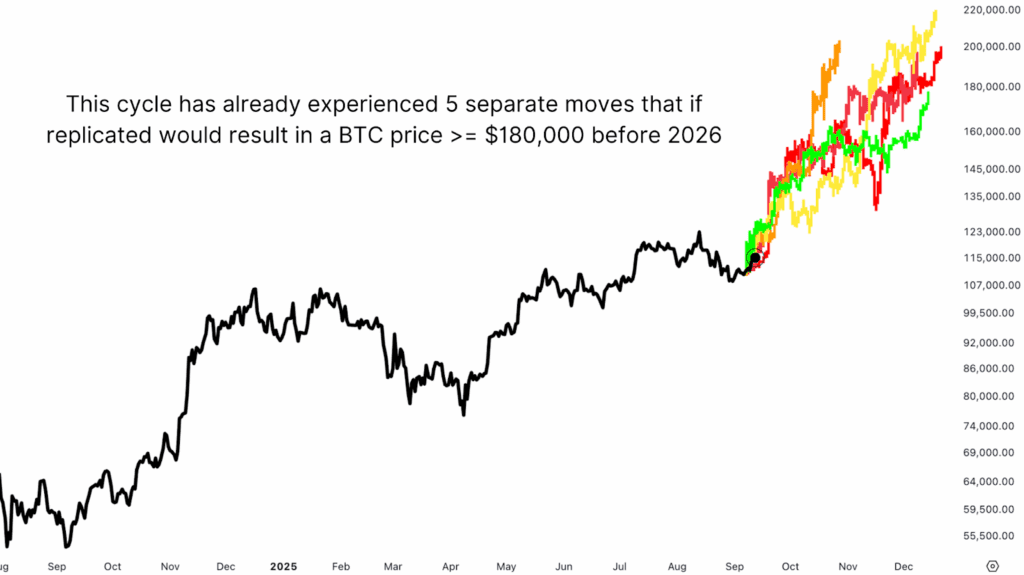

Maybe the strongest case for a blowoff high is that we’ve already seen parabolic rallies inside this very cycle. For the reason that 2022 backside, Bitcoin has staged a number of 60–100%+ runs in underneath 100 days. Overlaying these fractals onto present price motion gives life like outlines of how worth may attain $180,000–$220,000 earlier than year-end.

Bitcoin’s Parabolic Potential Stays Unshaken

The narrative that institutional adoption has eradicated parabolic blowoff tops underestimates each Bitcoin’s construction and human psychology. Bubbles aren’t an accident of retail hypothesis; they’re a recurring function of markets throughout historical past, usually accelerated by refined capital.

This doesn’t imply certainty, markets by no means work that means. However dismissing the opportunity of a parabolic high ignores centuries of market conduct and the distinctive supply-demand mechanics that make Bitcoin some of the reflexive belongings in historical past. If something, “this time is totally different” could solely imply that the rally might be larger, quicker, and extra dramatic than most count on.

For deeper information, charts, {and professional} insights into bitcoin worth traits, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for extra skilled market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.