Block, Inc., based by Jack Dorsey, the co-founder and ex-CEO of Twitter, is a monetary know-how firm with a deepening full-stack connection to the Bitcoin business by way of its subsidiaries. Its firms span funds apps and service provider tooling with Bitcoin integration, the event of bitcoin mining {hardware}, open supply software program growth, a decentralized finance protocol for peer-to-peer markets and even a self-custody {hardware} pockets.

Previously referred to as Sq. and founded in 2009, the corporate began integrating Bitcoin into its know-how providing as early as 2014 via Cash App — its most well-known subsidiary — permitting retailers to just accept bitcoin funds by way of the app. In 2021, Square Inc officially rebranded to Block Inc, doubling down on its dedication to Bitcoin and affirming its imaginative and prescient of the longer term as one the place the Bitcoin Blockchain would play a pivotal function. Sq. turned a subsidiary of Block Inc and now offers primarily with fee terminal know-how. As we speak, Block has 8,584 BTC on its balance sheet valued at nearly 1 billion {dollars}, with a mean buy value of 30,405 {dollars} per bitcoin.

Of Block’s subsidiaries and investments, most have specific connections to Bitcoin or blockchain programs corresponding to Money App, Bitkey, Proto, Spiral, TBD and Tidal. All of them are advancing Bitcoin adoption at varied ranges of the business and have rising affect and gratitude from the Bitcoin neighborhood. Jack Dorsey has been a number one donor to varied Bitcoin nonprofits and neighborhood efforts, together with OpenSats, which funds open supply Bitcoin growth and thru which quite a lot of Nostr — a Bitcoin-native social community protocol — has been bootstrapped.

In an unique interview with Bitcoin Journal, Miles Suter, product lead at Block, shared insights into the corporate’s imaginative and prescient for the longer term and Bitcoin’s superb function in it. He stated that, “We expect Bitcoin achieves its final future when it’s getting used as on a regular basis cash. Identical to Satoshi meant. I feel that Bitcoin as a worldwide monetary infrastructure that everybody can entry lets firms like Block function in a way more world method. And I feel that funds are important to sustaining the core properties that make Bitcoin distinctive and finally will make it win in the long term.”

Beneath you’ll discover brief overviews of a few of Block’s Bitcoin-related firms, notably these serving retail, with unique quotes from Suter on how they serve essential roles within the path to hyperbitcoinization.

Sq.

Launched in 2009, Sq. is a point-of-sale (POS) system enabling retailers to just accept card funds and handle operations like stock, payroll and enterprise loans. Serving 4 million sellers and processing $241 billion annually as of 2024, Sq. introduced that it started rolling out Bitcoin funds for retailers on the Bitcoin Vegas conference in 2025, permitting them to just accept bitcoin seamlessly by way of its POS {hardware}.

The transfer marks a serious milestone in Bitcoin’s integration with retail fee programs, establishing a lacking pillar up till now within the enterprise toolkit wanted to actually use bitcoin as a medium of trade. “On the Sq. aspect, we now have over 4 million retailers within the U.S. with a full suite of point-of-sale, stock, taxes, reporting, like the most effective within the enterprise by way of conventional funds processing. This initiative goes past simply Bitcoin funds,” stated Suter.

With the full-stack accounting integration of Bitcoin, retailers who wished to just accept the digital forex however couldn’t due to an absence of tooling now have the door extensive open. However the imaginative and prescient is bigger than that. “And we’re going to offer a full-stack Bitcoin banking suite particularly designed for small companies,” Suter added, leaning into the rising pattern of bitcoin treasury firms and methods that’s dominating Bitcoin information immediately.

Corporations will quickly have all of the instruments to just accept bitcoin funds and put them immediately into their firm treasury slightly than immediately promote bitcoin for {dollars}. In the event that they want liquidity, they’re already in a position to put that bitcoin as collateral and get dollar-denominated loans straight to their checking account by way of firms like Unchained — although, undoubtedly, Block can be transferring in that route for his or her shoppers. Suter added that “one factor I really like about this full-stack Bitcoin banking suite is that we’re democratizing entry to Bitcoin treasury instruments that had been beforehand solely obtainable to massive companies. I consider that holding Bitcoin in your stability sheet shouldn’t simply be a Wall Avenue luxurious.”

Money App

Money App, maybe probably the most famend model inside the Block portfolio, completes the retail funds aspect of the hyperbitcoinization engine Block is constructing. Launched in 2013, Money App is a consumer-focused digital pockets with a reported 57 million active users in 2024, providing person-to-person funds, debit playing cards, shares and Bitcoin buying and selling, and tax submitting. Money App reported $10 billion in bitcoin-sourced income in 2024, making up 62% the total, by charging ~2% per commerce.

Money App may also be the primary mainstream funds app to combine Lightning, Bitcoin’s funds community. It’s on the chopping fringe of the business, producing the best publicly disclosed, bitcoin-denominated income however working the Lightning Community at 9.7% return. This isn’t some bizarre crypto magic yield, and might solely be achieved by ensuring bitcoin funds are extremely environment friendly and dependable. Suter famous that “to me, it’s proof that Bitcoin is already a functioning fee community, not digital gold. It’s greater than that. And I don’t wish to get too into the weeds right here, however I can confidently say that we now have probably the most gifted set of Lightning engineers on this planet engaged on these issues.”

Exalted in regards to the success of Money App’s Bitcoin integration, Suter added that “we’re tremendous enthusiastic about Lightning’s function in making Bitcoin on a regular basis cash as a result of that’s actually, from a Block Inc. perspective, we consider that’s important for Bitcoin’s future, Satoshi’s unique imaginative and prescient, peer-to-peer digital money.”

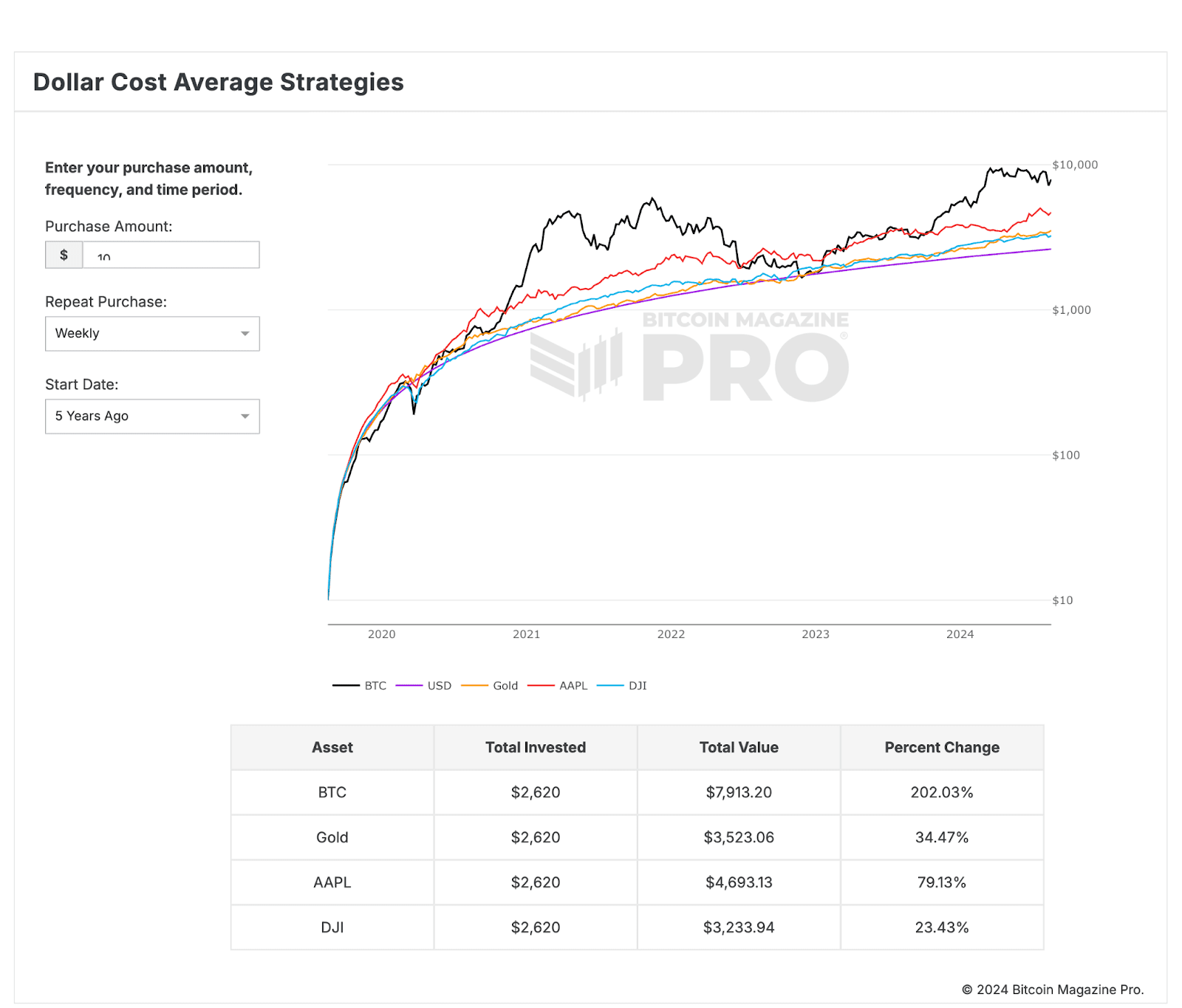

Customers can’t simply simply purchase and ship bitcoin by way of Money App, but in addition automate purchases, an funding technique referred to as DCA or greenback value averaging, which has been mathematically demonstrated to be one of the best investment strategies there are in bitcoin.

The mix of Money App and Sq. unlocks what tech individuals name a “fly wheel,” a time period used to explain self-reinforcing loops of client and enterprise habits that may drive a enterprise to new heights and which is normally not doable if a constructing block in that enterprise logic is lacking. Maybe with these two main integrations, the imaginative and prescient of Bitcoin funds dreamt about by early adopters for over a decade, which have probably not labored very nicely up till now, can lastly turn out to be a actuality.

Bitkey

Anchored within the basic worth proposition of Bitcoin — censorship resistance by way of particular person liberty and self custody — Block has launched a brand new {hardware} pockets product referred to as Bitkey. The system is designed particularly for Bitcoin safety, utilizing a preferred know-how referred to as multisignature, which decentralize the passwords — non-public keys— wanted to maneuver the bitcoin to 3 totally different units: the Bitkey {hardware}, a key saved for restoration in Block’s servers and a 3rd key encrypted with the consumer’s credentials and saved on the consumer’s chosen Google drive account.

The Bitkey, launched globally in 2024, makes varied design decisions that depart from the way in which different {hardware} wallets within the business operate — probably the most main and controversial distinction being that it by no means exhibits non-public key materials to the consumer. In contrast to each different {hardware} pockets and most self-custody Bitcoin and crypto apps, Bitkey hides key materials nearly solely from the consumer, as an alternative giving them varied well-designed instruments to safe, get well and inherit their bitcoin securely to their family members. Suter famous that “we constructed Bitkey to increase who can safely self-custody. We — Bitcoiners — joke that it is best to onboard your grandma to self-custody, however I hear numerous tales of that being true and other people reaching out as a result of the onboarding was so seamless.”

The system seems and looks like alien know-how, each unit with a novel combined stone sample, and that lights as much as the contact, like it’s alive. It’s a profound rethinking of self custody, born of a deep critique of the consumer expertise of the standard Bitcoin seed backup method. Whereas the design has been out there for barely a 12 months and no public information on gross sales numbers has been launched, it is going to be fascinating to see if they’ll break new floor into {hardware} pockets adoption — a metric traditionally poor for an business so culturally outlined by self custody.