Ethereum is about to enter into a brand new week, coming off of a week of fascinating value motion that noticed it buying and selling at its highest value ranges since 2021. On one hand, the Spot Ethereum ETFs that had driven billions in inflows have simply recorded their first every day outflow in over every week. Then again, order-book information exhibits a towering promote wall at $4,800 that could possibly be described as Ethereum’s “last boss,” the extent that might unlock a parabolic run if damaged.

Associated Studying

ETF Inflows Break: Sentiment Cooling Down?

The optimism round Ethereum’s rally cooled just because the week got here to an in depth. Notably, US-based Spot ETH ETFs reported web outflows of $59.34 million on August 15, successfully ending an eight-day streak that had added $3.7 billion in inflows.

The reversal got here simply as Ethereum did not clear $4,788, a stage within 3% of its all-time high of $4,878, earlier than slipping again to about $4,450. Though BlackRock’s ETHA stood out with $338.09 million in every day inflows, Grayscale’s ETHE and Constancy’s FETH registered notable withdrawals of $101.74 million and $272.23 million.

Total Ethereum Spot ETF Net Inflow: SoSoValue

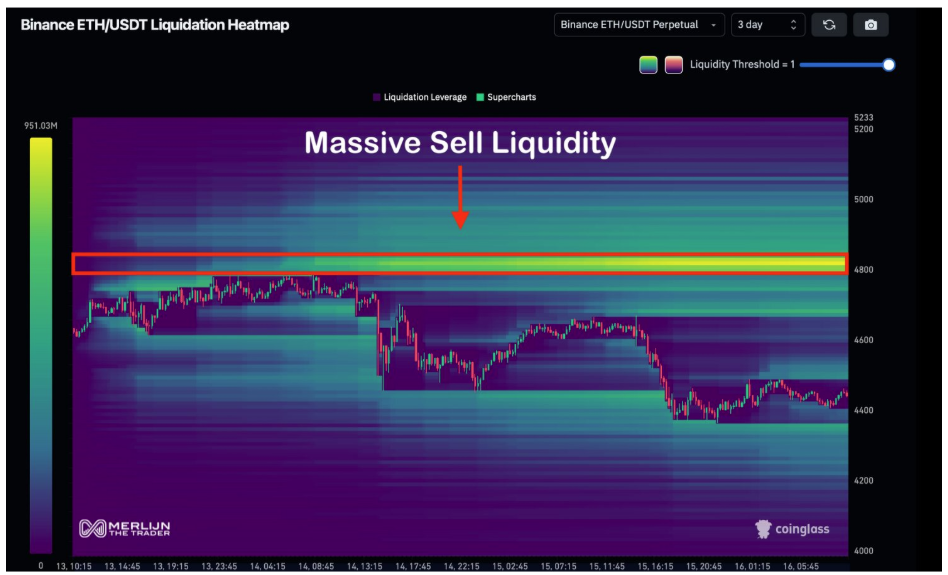

Talking of Ethereum failing to clear $4,788, on-chain information exhibits an enormous cluster of liquidity round this stage. Notably, Merlijn The Dealer described the $4,800 because the “last boss” for ETH, pointing to billions in promote orders stacked at that stage on Binance’s ETH/USDT pair.

A liquidity heatmap shows a massive concentration of asks on this zone. In keeping with the analyst, breaking above this stage might unleash open skies for Ethereum. So long as this stage is full of extra asks, there’s a risk of it performing as a resistance for any upward transfer. Nonetheless, clearing this fortress with enough buy volume wouldn’t simply be a technical breakout however a psychological one, with the potential to push its price to new all-time highs.

Image From X: Merlijn The Trader

Bearish Retracement State of affairs

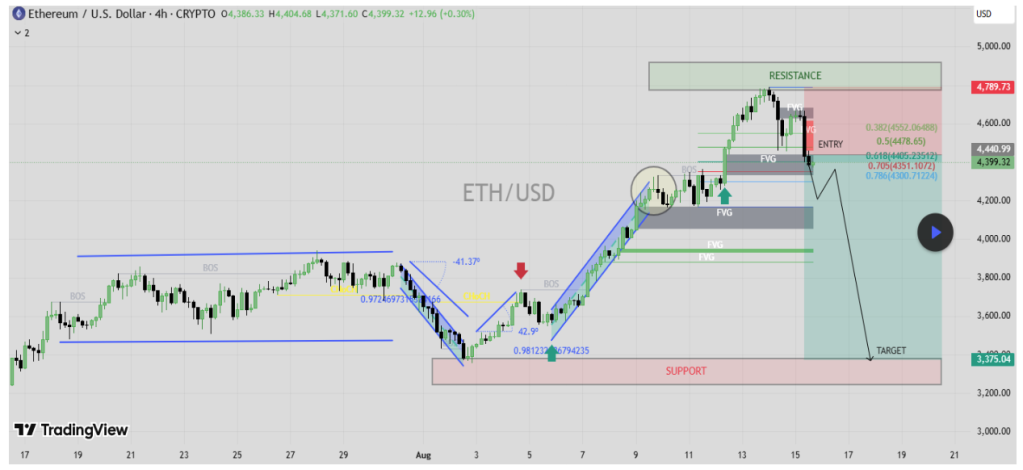

Though the liquidity narrative is presently leaning extra in the direction of a bullish breakout than bearish, one other evaluation from TradingView paints a extra cautious image. The evaluation, which is based on the 4-hour candlestick timeframe chart, additionally identifies the $4,700 to $4,800 area as a supply-heavy resistance the place Ethereum has already proven indicators of exhaustion after an aggressive rally from early August.

Nonetheless, a number of technical alignments, resembling Break of Construction alerts, honest worth gaps (FVG), and Fibonacci retracements, present that Ethereum could also be due for a retracement. The commerce plan outlined anticipates an entry round $4,440, with a cease loss above $4,790 and a draw back goal of $3,375 at a robust help space. This may indicate a corrective transfer of over 20% if the bearish projection performs out.

Associated Studying

On the time of writing, Ethereum was buying and selling at $4,465.

Featured picture from Unsplash, chart from TradingView