The Bitcoin value has slipped beneath $117,000 as on-chain information reveals the community has noticed one among its largest revenue realization days of the yr.

Bitcoin Lengthy-Time period Holders Did The Main Share Of Revenue-Taking

In a brand new post on X, the on-chain analytics agency Glassnode has talked concerning the newest pattern within the Bitcoin Realized Revenue indicator for the short-term holders and long-term holders. The “Realized Profit” measures, as its identify suggests, the entire quantity of revenue that the BTC buyers are realizing via their transactions.

The metric works by going via the switch historical past of every coin being bought to see what value it was moved at previous to this. The distinction between that earlier value and the present promoting value denote the quantity of revenue or loss concerned within the sale.

Naturally, the sale realizes a acquire if the distinction is constructive. The Realized Revenue provides up this worth concerned in all transactions of the kind occurring on the blockchain. One other indicator often called the Realized Loss retains observe of the gross sales of the other sort.

Within the context of the present dialogue, the Realized Revenue of two particular segments of the sector is of curiosity: short-term holders (STHs) and long-term holders (LTHs). Buyers are divided into these teams primarily based on the premise of holding time. Extra notably, holders who’ve been carrying their cash for 155 days or much less are put within the STHs and those that have made it previous this threshold are thought of LTHs.

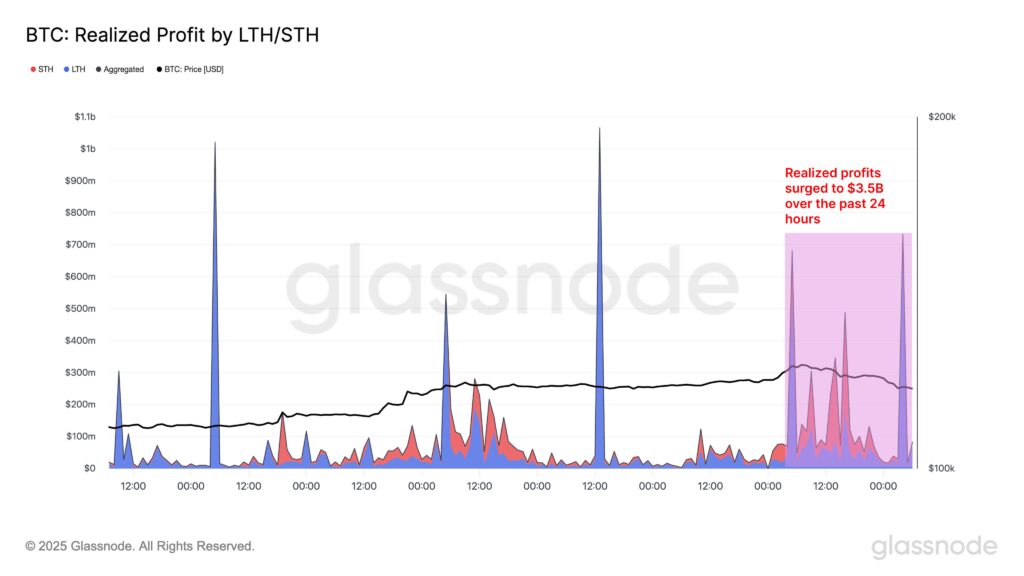

Beneath is the chart shared by Glassnode that reveals the pattern within the Realized Revenue for the 2 sides of the Bitcoin market.

As displayed within the graph, the Bitcoin Realized Revenue has seen spikes for each of those teams over the past 24 hours, implying buyers throughout the market have harvested features profiting from the rally to the brand new all-time high (ATH) above $123,000.

In complete, the holders took income equal to $3.5 billion inside this window, making the profit-taking occasion one of many largest for the yr. Curiously, the LTHs occupied for a better share ($1.96 billion or 56%) of the revenue realization than the STHs ($1.54 billion or 44%).

Usually, the longer an investor holds onto their cash, the much less possible they grow to be to promote them. As such, the LTHs with their comparatively lengthy holding time are thought of to characterize the resolute facet of the market.

Regardless of their sturdy resolve, nevertheless, it appears the most recent Bitcoin value surge offered a temptation sturdy sufficient for even these diamond palms to be swayed. The results of the selloff has thus far gave the impression to be a value decline to ranges beneath $117,000.

BTC Worth

On the time of writing, Bitcoin is floating round $116,700, up over 7% within the final week.