Bitcoin has seen “purchase the dip” mentions spike on social media after the worth crash, however Santiment warns this could possibly be a contrarian sign.

Social Media Customers Are Calling To Purchase The Bitcoin Dip

In a brand new Perception post, analytics agency Santiment has talked about how the market has been reacting to the latest plunge within the Bitcoin worth. “One of many first issues we prefer to search for is an indication of outlets exhibiting enthusiasm towards shopping for the dip,” notes Santiment.

The indicator cited by the analytics agency is the “Social Volume,” which measures the entire quantity of posts/messages/threads showing on the key social media platforms that make distinctive mentions of a given time period or matter.

Santiment has filtered the Social Quantity for Bitcoin-related key phrases and phrases pertaining to requires “purchase the dip.” Beneath is a chart exhibiting the pattern within the metric over the previous month.

As is seen within the graph, the Bitcoin Social Quantity has spiked for these phrases, indicating that curiosity in shopping for the dip has surged amongst social media customers. On the present worth, dip-buying calls are at their highest in 25 days.

Whereas this might sound like a sign {that a} rebound could also be coming quickly for the cryptocurrency, historical past has had many examples of the opposite. “Costs usually transfer the wrong way of the group’s expectations,” explains the analytics agency. Contemplating this, the dip-buying hype might really be an indication that extra ache could also be forward for BTC earlier than the underside can really be in.

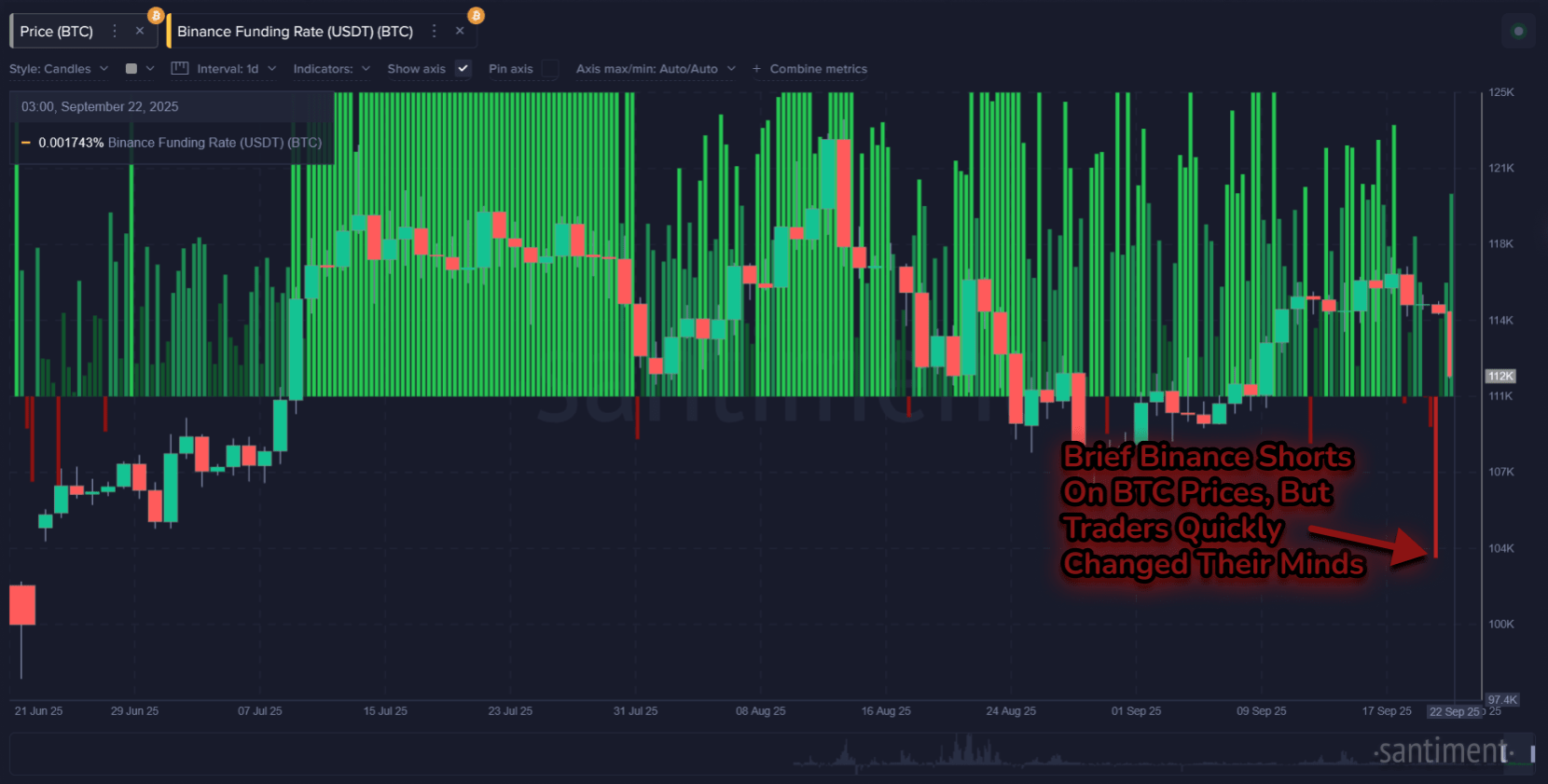

“As soon as the group stops feeling optimistic, they usually start to promote their baggage at a loss, that is usually the time to strike together with your dip buys,” says Santiment. One other gauge for market sentiment is thru the Binance Funding Rate, which is a metric that retains monitor of the periodic charge that derivatives merchants are exchanging between one another on the biggest cryptocurrency trade by buying and selling quantity.

The indicator turned sharp crimson simply forward of the most recent plummet within the Bitcoin worth, indicating that quick positions turned dominant on Binance. After the decline, nevertheless, merchants modified their tune because the metric switched again to being inexperienced.

This pattern would counsel that traders are hoping Bitcoin would rebound quickly. “Ideally, for a notable worth bounce to happen, we have to see a sustained interval of shorts outpacing longs,” notes the analytics agency. As such, this could possibly be one other indicator to regulate, as a flip into the detrimental for an prolonged section could pave the best way towards a backside.

BTC Worth

Bitcoin has been unable to make restoration from its crash as far as its worth continues to commerce round $112,700.