Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Josh Olszewicz expects Bitcoin to endure a grinding, probabilistic market over the following six weeks earlier than circumstances enhance into the fourth quarter, warning that September seasonality, softening momentum alerts, and blended ETF circulate dynamics argue for persistence quite than leverage. “The TL;DW might be chopped and bearish near-term, bullish This autumn,” he mentioned in an August 18 video, including that the trail to a cleaner upside impulse is explicitly conditional on a handful of technical and circulate triggers quite than a single catalyst.

The Battle Traces Are Drawn For Bitcoin

Olszewicz anchors the near-term roadmap in flows and seasonality. He needs “simply nothing—simply flatline on [ETF] flows for the following couple weeks after which 4 weeks of even worse,” arguing {that a} reset would “set us up for Q4.” Whereas he famous, “We did have $550 million in every week, which is fairly good for any ETF… nonetheless a strong quantity… not zero,” he contrasted that with earlier, a lot bigger weekly tallies and noticed that company treasury shopping for—“nonetheless plenty of sellers clearly if worth hasn’t gone anyplace”—has slowed from peak tempo. The implication just isn’t overt bearishness, however “time, not worth”: both sharp pullbacks in names that ran or “useless sideways for six weeks.”

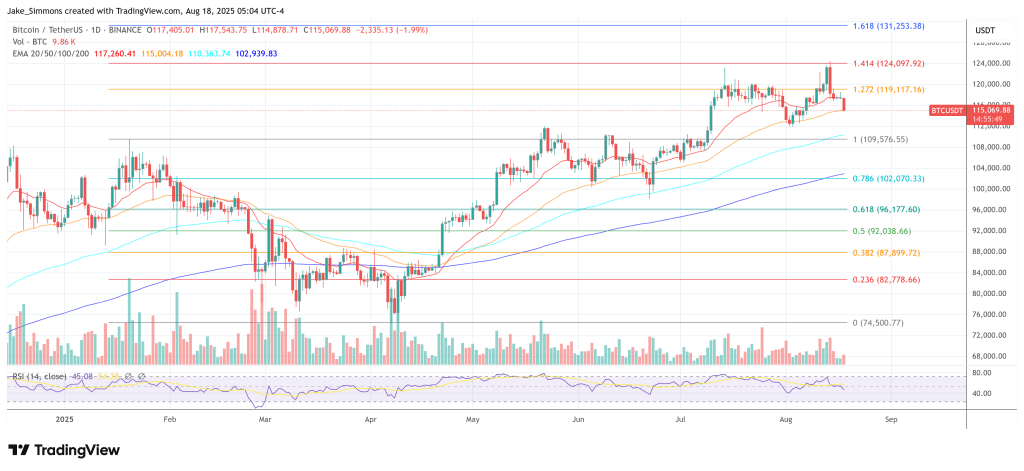

On Bitcoin’s chart, Olszewicz reduces the talk to a well-defined line within the sand and a small set of Ichimoku- and trend-based triggers. “Since July… $121–$122,000 remains to be the imaginary line within the sand… a every day shut above that stage, I’m good with greater,” he mentioned, including, “Above $120,000 it’s simple. I like $150,000.” Till that break, he sees “chop” dominating.

He identifies “the primary indicators of bother” as “closing within the every day cloud and/or closing under the 20-week transferring common—the yellow line there at $104,000,” and stresses the timing nuance: “If we get a detailed under the cloud in September, I’m rather less fearful than if we get it in October.” A decisive slip late in Q3 rolling into This autumn could be extra regarding. “If we shut under $100k in October, then I’m nearer to this cycle-over, no-more-cycles camp,” he warned, clarifying, “We’re removed from that at present… there’s nothing right here that’s bearish by any means—it’s simply momentumless.”

His most well-liked system-of-confirmation leans on the Ichimoku suite and a separate cloud backtest he tracks on the BTC every day chart. That mannequin “caught [the] April transfer” early; at current it reads “okay,” however he outlines the exact sequence that will flip his bias: “You want first the bearish TK cross… after which a detailed within the cloud… then there’s an honest edge-to-edge commerce.” It’s a choice tree, not a prediction: “It’s nuanced… if this, then that.”

Macro timing may add friction within the interim. He factors to Friday’s Jackson Gap look by Federal Reserve Chair Jerome Powell as the one apparent near-term “catalyst,” suggesting a hawkish tone—“not reducing, needing extra information, needing extra time”—could be a headwind.

He additionally mused that “Trump could even announce his substitute earlier than Powell speaks… simply to steal the thunder,” framing it as a headline-risk issue for threat property, not a base case. Nonetheless, the bigger macro backdrop—rising international cash provide and debt—stays a structural tailwind for scarce property, in his view: “That’s going to offer a pleasant cushion… as they preserve printing cash all over the place globally.”

Ready For The This autumn Seasonality

Olszewicz emphasizes that this doesn’t preclude upside, however it does undercut the likelihood of trending continuation within the very close to time period. Against this, he calls Ethereum’s positioning “horrific… for the lengthy aspect,” at the same time as ETH simply printed a record ETF-flow week—an obvious paradox he resolves by distinguishing one-week surges from the “stream of steady flows” that sustains traits. The comparability issues for Bitcoin as a result of a broad-based crypto threat bid is tougher to keep up if ETH’s positioning and overbought technicals stall management.

Associated Studying

Inside Bitcoin’s personal market construction, Olszewicz blends tactical warning with the longer-term thesis many cycle buyers nonetheless maintain. He flags that “August has been bullish” to date however notes the historic rarity of “six months in a row” of inexperienced closes, and he reiterates that merchants on the lookout for “high-conviction strikes” with leverage ought to want to attend for alerts quite than pressure publicity in “nothingness.”

Conversely, for long-horizon holders, he cites the power-law hall as a cause to keep away from second-guessing until the market fails badly into This autumn: “For those who suppose there’s a… 30–50% probability that we really try a parabolic transfer previous the midpoint of the ability regulation… it’s in all probability simply value sitting tight as an investor and saying, okay, present it to me.”

That framework additionally explains his tolerance for deeper retests with out abandoning the bigger uptrend. He repeats that there’s “loads [of] room to get offended and go down,” with the 20-week transferring common and every day cloud serving as goal guardrails. A September cloud break is a warning; an October cloud break or an October shut under $100k could be a far stronger assertion in regards to the cycle’s well being. Till then, he expects a market “holding ranges,” with $121,000–$122,000 because the set off that will convert “useless momentum” into a real impulse.

For Bitcoin merchants, the takeaway is spare and unsentimental. There isn’t a “magical setup” this week, and the statistically unfriendly month of September looms. The bullish path into This autumn exists, however it have to be earned: Within the meantime, Olszewicz’s baseline is both rangebound “nothingness” or opportunistic pullbacks that reset overheated pockets of the market. The contingency that flips that script is evident sufficient to put in writing on a Submit-it: preserve the cloud, defend the 20-week round $104,000, and shut decisively above $121,000–$122,000. Solely then, Bitcoin may goal $150,000.”

At press time, BTC traded at $115,069.

Featured picture created with DALL.E, chart from TradingView.com