Grupo Murano, a $1 billion actual property agency primarily based in Mexico, is pioneering a daring technique to combine bitcoin into its operations, with CEO Elías Sacal arguing that bitcoin is “demonetizing” the actual property trade. By shifting from conventional asset-heavy fashions to a bitcoin-centric treasury, the publicly traded firm goals to optimize its funds and capitalize on bitcoin’s potential appreciation, providing a mannequin for companies navigating risky rates of interest and currencies.

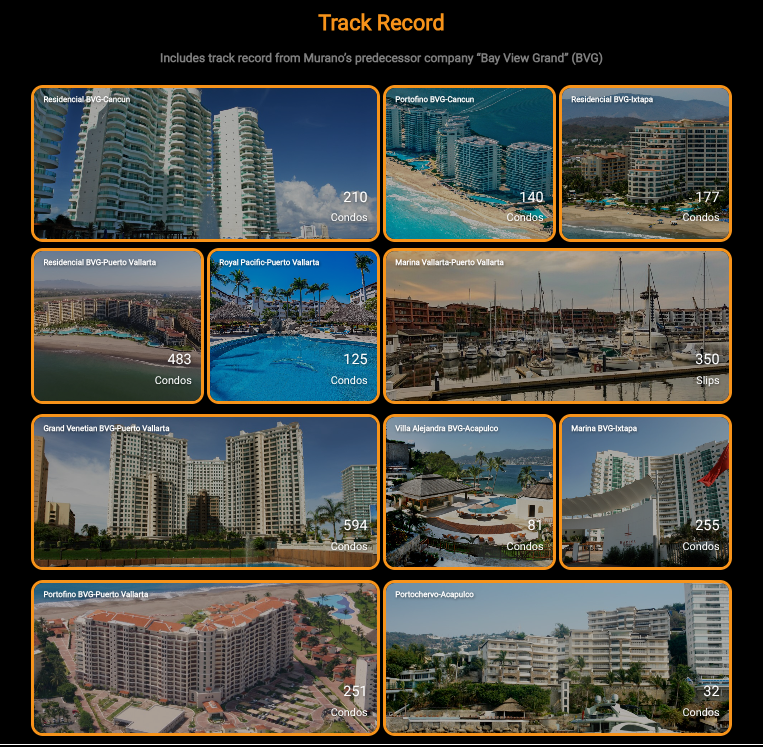

In an unique interview on the Bitcoin for Corporations show, Sacal, a 30-year veteran of actual property improvement, outlined Grupo Murano’s imaginative and prescient. The agency, which manages motels beneath manufacturers like Hyatt and Mondrian in addition to residential and commercial properties in cities like Cancun and Mexico Metropolis, plans to transform property into bitcoin via refinancing and sale-leasebacks. This strategy reduces debt and fairness on its steadiness sheet whereas sustaining operational management. “As an alternative of buildings ready for small appreciation, we consider bitcoin will recognize extra,” Sacal mentioned, predicting a possible 300% value enhance inside 5 years.

Sacal’s technique addresses the actual property trade’s reliance on debt financing, which has been disrupted by rising rates of interest — leaping from 4% to 9% in some instances. “Actual property must be unbiased of the speed of tomatoes or Walmart inflation,” he famous, emphasizing Bitcoin’s stability for transactions like sourcing supplies globally or accepting lodge funds. By eliminating middlemen resembling hedge funds and portfolio managers, bitcoin reduces prices from commissions and trade charges. A $100 cost, Sacal defined, typically shrinks to $85 after charges, however bitcoin makes these funds extra environment friendly.

Grupo Murano can be educating stakeholders — staff, traders and company — about Bitcoin’s advantages. The agency plans to deploy Bitcoin ATMs in its properties and is finalizing a partnership with a significant cost platform to allow seamless transactions, notably for American-oriented lodge company in Cancun and Mexico Metropolis. This aligns with Murano’s bold aim to construct a $10 billion bitcoin treasury inside 5 years, impressed by Technique’s $100 billion valuation, acquired primarily via adopting bitcoin. Murano can be seeking to settle for bitcoin funds all through its portfolio and will probably be exploring alternatives to host Bitcoin conferences at its areas.

The corporate’s focus stays on high-margin improvement tasks, allocating 20-30% of its enterprise to actual property and 70-80% to bitcoin holdings. Sacal dismissed different cryptocurrencies, calling bitcoin “the champion, like Method One or the NFL.” He sees Latin America, led by pioneers like El Salvador, as a fertile floor for Bitcoin adoption, although political dangers stay. Bitcoin may unify regional economies, lowering dependence on tourism or remittances.

For Bitcoin Journal’s viewers, Grupo Murano’s pivot highlights Bitcoin’s potential to remodel capital-intensive industries. By prioritizing improvement over possession and leveraging Bitcoin’s appreciation, Murano provides a playbook for companies searching for resilience in opposition to financial volatility. As Sacal places it, “Finally, actual property globally will probably be dominated by Bitcoin transactions,” signaling a shift towards a extra secure, decentralized future.

Bitcoin for Companies is an initiative owned by BTC Inc., the guardian firm of Bitcoin Journal. BTC Inc. operates varied subsidiaries targeted on the digital property trade and has a enterprise relationship with Group Murano.