XRP is struggling to reclaim larger value ranges as persistent promoting strain and broader market uncertainty proceed to weigh on sentiment. Regardless of intermittent rebound makes an attempt, momentum stays fragile, with merchants hesitant to commit capital amid elevated volatility and cautious liquidity situations. The asset has but to ascertain a convincing larger excessive, reinforcing the notion that XRP stays in a transitional part moderately than a confirmed restoration pattern.

Associated Studying

A latest CryptoQuant report offers further context by way of change move information. In keeping with the evaluation, Binance recorded a pointy spike in XRP change inflows throughout a beforehand highlighted interval that preceded a powerful rally. Massive inflows sometimes mirror tokens shifting onto exchanges, a dynamic typically interpreted as potential promote strain since belongings turn into available for liquidation. Such spikes can improve short-term provide and amplify volatility.

Nevertheless, inflows don’t all the time lead to fast distribution. Within the referenced case, the surge in change deposits coincided with rising volatility and in the end preceded a major value enlargement. This implies that some influx occasions might signify strategic positioning, liquidity preparation, or inner reallocation moderately than outright promoting. As XRP navigates present uncertainty, monitoring change move conduct stays essential for assessing whether or not renewed volatility might as soon as once more precede a directional breakout.

The report explains that liquidity dynamics present essential context for understanding XRP market construction, notably when evaluating volatility danger and potential value inflection factors. USD liquidity measures the depth of capital supporting XRP buying and selling pairs. Throughout the earlier rally part, USD liquidity expanded considerably, permitting value advances to be absorbed with out extreme volatility. Not too long ago, nonetheless, USD liquidity has been declining, suggesting thinner market depth in contrast with the enlargement interval. Diminished depth sometimes will increase sensitivity to order move and might amplify value swings.

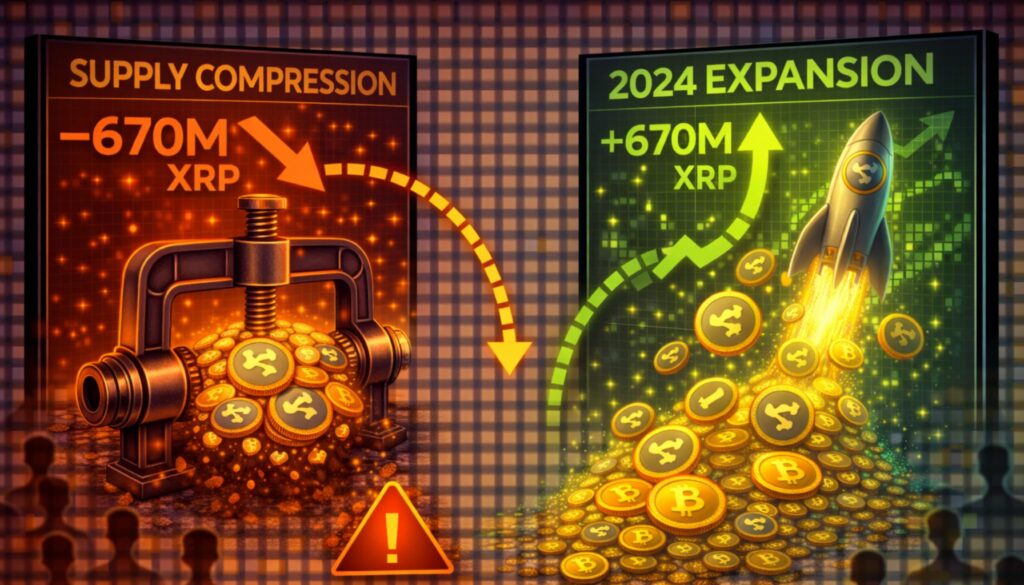

Liquidity measured in XRP phrases displays the provision of tokens on the promote facet. Previous to the final main breakout, XRP liquidity compressed notably, indicating diminished lively provide on exchanges. That contraction part aligned intently with the start of the robust upward transfer. Presently, XRP liquidity is trending decrease once more, displaying similarities with earlier pre-expansion situations.

Traditionally, this mixture of change influx spikes alongside liquidity compression has preceded volatility enlargement. Rising USD liquidity tends to assist sustained developments, whereas declining liquidity typically introduces fragility into market construction.

At current, change inflows stay average, however each USD and XRP liquidity are contracting. This implies a thinner surroundings the place value reactions might turn into sharper. These indicators present structural context, however they need to be evaluated alongside derivatives positioning, funding developments, and broader macro situations earlier than drawing directional conclusions.

Associated Studying

XRP stays beneath sustained technical strain, with the weekly chart reflecting a transparent corrective part following the sharp rally that pushed the value above the $3.00 area in 2025. Since that peak, value construction has shifted towards a sequence of decrease highs and decrease lows, a sample sometimes related to weakening momentum moderately than consolidation. The latest transfer towards the $1.40 space highlights continued promoting strain and cautious positioning amongst market individuals.

From a technical standpoint, XRP is at the moment buying and selling under key shifting averages that beforehand acted as dynamic assist. These averages now operate as overhead resistance, limiting upside makes an attempt except value can reclaim them decisively. The shorter-term common has rolled over extra aggressively, whereas the longer-term pattern line stays upward sloping however lagging, suggesting residual macro assist alongside deteriorating short-term momentum.

Associated Studying

Quantity exercise has moderated in contrast with the impulsive rally part, indicating diminished speculative participation. Nevertheless, declining quantity throughout corrections also can sign vendor exhaustion if accompanied by stabilization in value construction.

Fast assist seems concentrated close to the latest lows across the $1.30–$1.40 zone, whereas resistance stays clustered close to the $1.80–$2.20 vary. Till XRP reclaims larger ranges with robust participation, the broader pattern stays fragile.

Featured picture from ChatGPT, chart from TradingView.com