From the start, Bitcoin’s rise has been nothing wanting legendary. Priced at simply $0.07 on August 17, 2010, it has skyrocketed $100,000+ into 2025, creating wealth, rewriting funding playbooks, and cementing its place as a cornerstone of the longer term monetary system.

Bitcoin Journal Professional knowledge reveals that out of 5,442 complete days since Bitcoin first started buying and selling, 5,441 have been worthwhile when in comparison with as we speak’s value, a rare 99.98% success charge. For individuals who believed early and held by the volatility, the reward has been historic.

The evaluation of Bitcoin’s every day value historical past additionally reveals that over 80 % of all buying and selling days have been worthwhile, which means the present value is larger than the worth on these days. This degree of consistency has grow to be a key motive why so many long run traders proceed to hodl with confidence.

Since 2013, the worldwide provide of cash (M2) has grown from about $61 trillion to over $102 trillion. Throughout that very same interval, Bitcoin’s value jumped from round $113 to greater than $118,000 at its peak. This pattern exhibits a powerful connection between the rise in world cash provide and the rise in Bitcoin’s worth, supporting the concept Bitcoin acts as a hedge in opposition to inflation and a dependable retailer of worth.

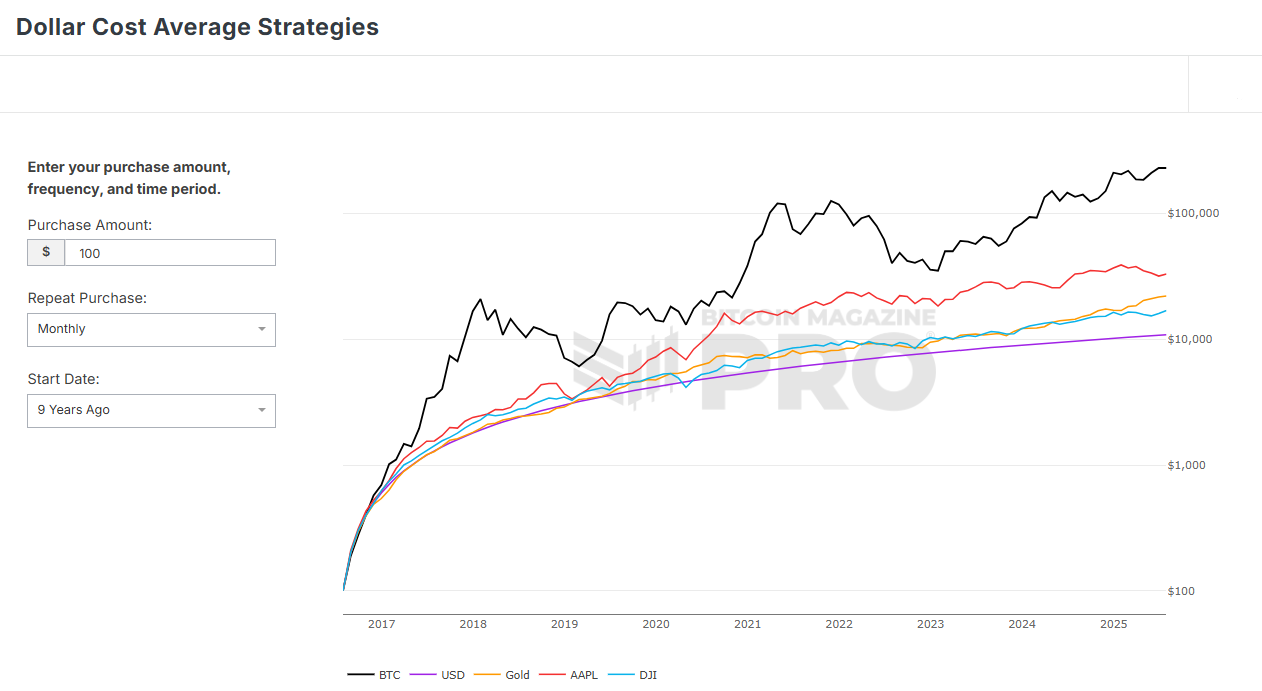

In response to Bitcoin Magazine Pro, in case you had greenback value averaged (DCA) $100 a month into Bitcoin over the previous 9 years, you’d be sitting on over $230,670 as we speak, from only a $10,900 complete funding, with a return of over 2,016%.

As compared, gold had returns of 103% which might have turned the funding of $10,900 into $22,152, Apple inventory of 204% into $33,081, and Dow Jones Industrial (DJI) 56% into 16,993. Bitcoin simply surpasses the returns of conventional property like gold, Apple inventory, or the DJI.

The Greenback Price Common Methods instrument from Bitcoin Journal Professional helps customers discover Bitcoin investments throughout completely different timeframes. By evaluating Bitcoin’s efficiency to property just like the US greenback, gold, Apple inventory, and the DJI, the instrument highlights Bitcoin’s potential as a number one retailer of worth inside a diversified funding portfolio. These concerned about view Bitcoin Journal Professional knowledge can achieve this here.